Page 17 - Insurance Times March 2017 Sample

P. 17

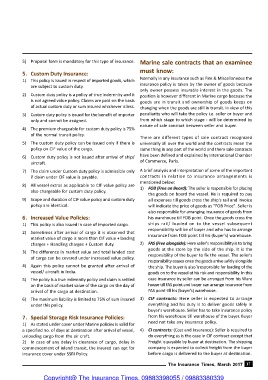

5) Proposal form is mandatory for this type of insurance. Marine sale contracts that an examinee

must know:

5. Custom Duty Insurance:

Normally in any insurance such as Fire & Miscellaneous the

1) This policy is issued in respect of imported goods, which

are subject to custom duty. insurance policy is taken by the owner of goods because

only owner possess insurable interest in the goods. The

2) Custom duty policy is a policy of true indemnity and it position is however different in Marine cargo because the

is not agreed value policy. Claims are paid on the basis goods are in transit and ownership of goods keeps on

of actual custom duty or sum insured whichever is less. changing when the goods are still in transit. In view of this

3) Custom duty policy is issued for the benefit of importer peculiarity who will take the policy i.e. seller or buyer and

only and cannot be assigned. from which stage to which stage - will be determined by

nature of sale contract between seller and buyer.

4) The premium chargeable for custom duty policy is 75%

of the normal transit policy.

There are different types of sale contract recognized

5) The custom duty policy can be issued only if there is universally all over the world and the contracts mean the

policy on CIF value of the cargo. same thing in any part of the world and there sale contracts

6) Custom duty policy is not issued after arrival of ship/ have been defined and explained by International Chamber

aircraft. of Commerce, Paris.

7) The claim under Custom duty policy is admissible only A brief analysis and interpretation of some of the important

if claim under CIF value is payable. contracts in relation to insurance arrangements is

mentioned below:

8) All vessel extras as applicable to CIF value policy are 1) FOB (Free on Board): The seller is responsible for placing

also chargeable for custom duty policy.

the goods on board the vessel. He is required to pay

9) Scope and duration of CIF value policy and custom duty all expenses till goods cross the ship's rail and invoice

policy are identical. will indicate the price of goods as "FOB Price". Seller is

also responsible for arranging insurance of goods from

6. Increased Value Policies: his warehouse till FOB point. Once the goods cross the

1) This policy is also issued in case of imported cargo. ships rail/ loaded on to the vessel subsequent

responsibility will be of buyer and who has to arrange

2) Sometimes after arrival of cargo it is observed that

market value of cargo is more than CIF value + landing insurance from FOB point till his (buyer's) warehouse.

charges + Handling charges + Custom duty. 2) FAS (Free alongside): Here seller's responsibility is to bring

goods at the store by the side of the ship. It is the

3) The difference in market value and total landed cost

responsibility of the buyer to fix the vessel. The seller's

of cargo can be covered under increased value policy.

responsibility ceases once the goods arrive safely alongside

4) Again this policy cannot be granted after arrival of the ship. The buyer is also \responsible for loading of the

vessel/ aircraft in India. goods on to the vessel at his risk and responsibility. In this

5) The policy is a true indemnity policy and claim is settled case insurance by seller can be arranged from his Ware

on the basis of market value of the cargo on the day of house till FAS point and buyer can arrange insurance from

arrival of the cargo at destination. FAS point till his (buyer's) warehouse.

6) The maximum liability is limited to 75% of sum insured 3) CIF contracts: Here seller is expected to arrange

under this policy. everything and his duty is to deliver goods safely in

buyer's warehouse. Seller has to take insurance policy

7. Special Storage Risk Insurance Policies: from his warehouse till warehouse of the buyer. Buyer

need not take any insurance policy.

1) As stated under cover under Marine policies is valid for

a specified no. of days at destination after arrival of vessel, 4) CI contracts: (Cost and Insurance): Seller is required to

unloading cargo from the air craft. do everything as is the case in CIF contract except that

2) In case of any delay in clearance of cargo, delay in Freight is payable by buyer at destination. The shipping

commencement of inland transit, the insured can opt for company is expected to collect freight from the buyer

insurance cover under SSRI Policy. before cargo is delivered to the buyer at destination.

The Insurance Times, March 2017 17

Copyright@ The Insurance Times. 09883398055 / 09883380339