Page 29 - The Insurance Times June 2020

P. 29

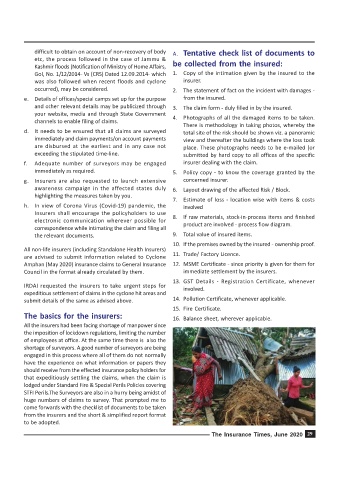

difficult to obtain on account of non-recovery of body A. Tentative check list of documents to

etc, the process followed in the case of Jammu &

Kashmir floods (Notification of Ministry of Home Affairs, be collected from the insured:

GoI, No. 1/12/2014- Vs (CRS) Dated 12.09.2014- which 1. Copy of the intimation given by the insured to the

was also followed when recent floods and cyclone insurer.

occurred), may be considered. 2. The statement of fact on the incident with damages -

e. Details of offices/special camps set up for the purpose from the insured.

and other relevant details may be publicized through 3. The claim form - duly filled in by the insured.

your website, media and through State Government

channels to enable filing of claims. 4. Photographs of all the damaged items to be taken.

There is methodology in taking photos, whereby the

d. It needs to be ensured that all claims are surveyed total site of the risk should be shown viz. a panoramic

immediately and claim payments/on account payments view and thereafter the buildings where the loss took

are disbursed at the earliest and in any case not place. These photographs needs to be e-mailed (or

exceeding the stipulated time-line. submitted by hard copy to all offices of the specific

f. Adequate number of surveyors may be engaged insurer dealing with the claim.

immediately as required. 5. Policy copy - to know the coverage granted by the

g. Insurers are also requested to launch extensive concerned insurer.

awareness campaign in the affected states duly 6. Layout drawing of the affected Risk / Block.

highlighting the measures taken by you.

7. Estimate of loss - location wise with items & costs

h. In view of Corona Virus (Covid-19) pandemic, the involved

Insurers shall encourage the policyholders to use

electronic communication wherever possible for 8. If raw materials, stock-in-process items and finished

correspondence while intimating the claim and filing all product are involved - process flow diagram.

the relevant documents. 9. Total value of insured items.

10. If the premises owned by the insured - ownership proof.

All non-life insurers (including Standalone Health Insurers)

are advised to submit information related to Cyclone 11. Trade/ Factory Licence.

Amphan (May 2020) insurance claims to General Insurance 12. MSME Certificate - since priority is given for them for

Council in the format already circulated by them. immediate settlement by the insurers.

13. GST Details - Registration Certificate, whenever

IRDAI requested the insurers to take urgent steps for involved.

expeditious settlement of claims in the cyclone hit areas and

submit details of the same as advised above. 14. Pollution Certificate, whenever applicable.

15. Fire Certificate.

The basics for the insurers: 16. Balance sheet, wherever applicable.

All the insurers had been facing shortage of manpower since

the imposition of lockdown regulations, limiting the number

of employees at office. At the same time there is also the

shortage of surveyors. A good number of surveyors are being

engaged in this process where all of them do not normally

have the experience on what information or papers they

should receive from the effected insurance policy holders for

that expeditiously settling the claims, when the claim is

lodged under Standard Fire & Special Perils Policies covering

STFI Perils.The Surveyors are also in a hurry being amidst of

huge numbers of claims to survey. That prompted me to

come forwards with the checklist of documents to be taken

from the insurers and the short & simplified report format

to be adopted.

The Insurance Times, June 2020 29