Page 22 - The Insurance Times October 2021

P. 22

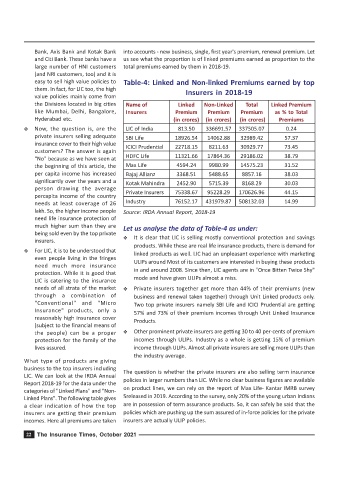

Bank, Axis Bank and Kotak Bank into accounts - new business, single, first year's premium, renewal premium. Let

and Citi Bank. These banks have a us see what the proportion is of linked premiums earned as proportion to the

large number of HNI customers total premiums earned by them in 2018-19.

(and NRI customers, too) and it is

easy to sell high value policies to Table-4: Linked and Non-linked Premiums earned by top

them. In fact, for LIC too, the high Insurers in 2018-19

value policies mainly come from

the Divisions located in big cities Name of Linked Non-Linked Total Linked Premium

like Mumbai, Delhi, Bangalore, Insurers Premium Premium Premium as % to Total

Hyderabad etc. (in crores) (in crores) (in crores) Premiums

Y Now, the question is, are the LIC of India 813.50 336691.57 337505.07 0.24

private insurers selling adequate SBI Life 18926.54 14062.88 32989.42 57.37

insurance cover to their high value ICICI Prudential 22718.15 8211.63 30929.77 73.45

customers? The answer is again

HDFC Life 11321.66 17864.36 29186.02 38.79

"No" because as we have seen at

the beginning of this article, the Max Life 4594.24 9980.99 14575.23 31.52

per capita income has increased Bajaj Allianz 3368.51 5488.65 8857.16 38.03

significantly over the years and a Kotak Mahindra 2452.90 5715.39 8168.29 30.03

person drawing the average

percapita income of the country Private Insurers 75338.67 95228.29 170626.96 44.15

needs at least coverage of 26 Industry 76152.17 431979.87 508132.03 14.99

lakh. So, the higher income people Source: IRDA Annual Report, 2018-19

need life insurance protection of

much higher sum than they are Let us analyse the data of Table-4 as under:

being sold even by the top private

Y It is clear that LIC is selling mostly conventional protection and savings

insurers.

products. While these are real life insurance products, there is demand for

Y For LIC, it is to be understood that linked products as well. LIC had an unpleasant experience with marketing

even people living in the fringes

need much more insurance ULIPs around Most of its customers are interested in buying these products

protection. While it is good that in and around 2008. Since then, LIC agents are in "Once Bitten Twice Shy"

mode and have given ULIPs almost a miss.

LIC is catering to the insurance

needs of all strata of the market Y Private insurers together get more than 44% of their premiums (new

through a combination of business and renewal taken together) through Unit Linked products only.

"Conventional" and "Micro Two top private insurers namely SBI Life and ICICI Prudential are getting

Insurance" products, only a 57% and 73% of their premium incomes through Unit Linked Insurance

reasonably high insurance cover Products.

(subject to the financial means of

the people) can be a proper Y Other prominent private insurers are getting 30 to 40 per-cents of premium

protection for the family of the incomes through ULIPs. Industry as a whole is getting 15% of premium

lives assured. income through ULIPs. Almost all private insurers are selling more ULIPs than

the industry average.

What type of products are giving

business to the top insurers including

The question is whether the private insurers are also selling term insurance

LIC. We can look at the IRDA Annual

policies in larger numbers than LIC. While no clear business figures are available

Report 2018-19 for the data under the

categories of "Linked Plans" and "Non- on product lines, we can rely on the report of Max Life- Kantar IMRB survey

Linked Plans". The following table gives 5released in 2019. According to the survey, only 20% of the young urban Indians

a clear indication of how the top are in possession of term assurance products. So, it can safely be said that the

insurers are getting their premium policies which are pushing up the sum assured of in-force policies for the private

incomes. Here all premiums are taken insurers are actually ULIP policies.

22 The Insurance Times, October 2021