Page 27 - The Insurance Times October 2021

P. 27

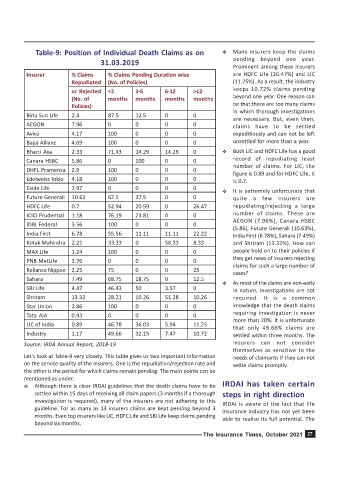

Table-9: Position of Individual Death Claims as on Y Many insurers keep the claims

pending beyond one year.

31.03.2019

Prominent among these insurers

Insurer % Claims % Claims Pending Duration wise are HDFC Life (26.47%) and LIC

Repudiated (No. of Policies) (11.25%). As a result, the industry

keeps 10.72% claims pending

or Rejected <3 3-6 6-12 >12

beyond one year. One reason can

(No. of months months months months

Policies) be that there are too many claims

in which thorough investigations

Birla Sun Life 2.4 87.5 12.5 0 0

are necessary. But, even then,

AEGON 7.96 0 0 0 0 claims have to be settled

Aviva 4.17 100 0 0 0 expeditiously and can not be left

Bajaj Allianz 4.69 100 0 0 0 unsettled for more than a year.

Bharti Axa 2.33 71.43 14.29 14.29 0 Y Both LIC and HDFC Life has a good

Canara HSBC 5.86 0 100 0 0 record of repudiating least

number of claims. For LIC, the

DHFL Pramerica 2.9 100 0 0 0

figure is 0.89 and for HDFC Life, it

Edelweiss Tokio 4.18 100 0 0 0 is 0.7.

Exide Life 2.97 0 0 0 0

Y It is extremely unfortunate that

Future Generali 10.63 62.5 37.5 0 0 quite a few insurers are

HDFC Life 0.7 52.94 20.59 0 26.47 repudiating/rejecting a large

ICICI Prudential 1.18 76.19 23.81 0 0 number of claims. These are

AEGON (7.96%), Canara HSBC

IDBI Federal 3.56 100 0 0 0

(5.86), Future Generali (10.63%),

India First 6.78 55.56 11.11 11.11 22.22 India First (6.78%), Sahara (7.49%)

Kotak Mahindra 2.21 33.33 0 58.33 8.33 and Shriram (13.32%). How can

MAX Life 1.24 100 0 0 0 people hold on to their policies if

they get news of insurers rejecting

PNB MetLife 3.76 0 0 0 0

claims for such a large number of

Reliance Nippon 2.25 75 0 0 25

cases?

Sahara 7.49 68.75 18.75 0 12.5

Y As most of the claims are non-early

SBI Life 4.47 46.43 50 3.57 0 in nature, investigations are not

Shriram 13.32 28.21 10.26 51.28 10.26 required. It is a common

Star Union 2.86 100 0 0 0 knowledge that the death claims

requiring investigation is never

Tata AIA 0.93 0 0 0 0

more than 20%. It is unfortunate

LIC of India 0.89 46.78 36.03 5.94 11.25

that only 49.66% claims are

Industry 1.17 49.66 32.15 7.47 10.72 settled within three months. The

Source: IRDA Annual Report, 2018-19 insurers can not consider

themselves as sensitive to the

Let's look at Table-9 very closely. This table gives us two important information needs of claimants if they can not

on the service quality of the insurers. One is the repudiation/rejection rate and settle claims promptly.

the other is the period for which claims remain pending. The main points can be

mentioned as under:

Y Although there is clear IRDAI guidelines that the death claims have to be IRDAI has taken certain

settled within 15 days of receiving all claim papers (3 months if a thorough steps in right direction

investigation is required), many of the insurers are not adhering to this

IRDAI is aware of the fact that life

guideline. For as many as 13 insurers claims are kept pending beyond 3 insurance industry has not yet been

months. Even top insurers like LIC, HDFC Life and SBI Life keep claims pending able to realise its full potential. The

beyond six months.

The Insurance Times, October 2021 27