Page 23 - The Insurance Times October 2021

P. 23

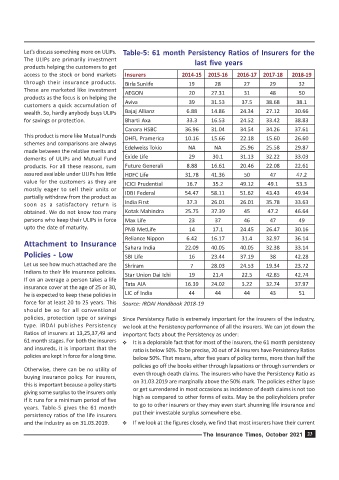

Let's discuss something more on ULIPs. Table-5: 61 month Persistency Ratios of Insurers for the

The ULIPs are primarily investment last five years

products helping the customers to get

access to the stock or bond markets Insurers 2014-15 2015-16 2016-17 2017-18 2018-19

through their insurance products. Birla Sunlife 19 28 27 29 32

These are marketed like investment

AEGON 20 27.31 31 48 50

products as the focus is on helping the

Aviva 39 31.53 37.5 38.68 38.1

customers a quick accumulation of

wealth. So, hardly anybody buys ULIPs Bajaj Allianz 6.88 14.86 24.34 27.12 30.66

for savings or protection. Bharti Axa 33.3 16.53 24.52 33.42 38.83

Canara HSBC 36.96 31.04 34.54 34.26 37.61

This product is more like Mutual Funds

DHFL Pramerica 10.16 15.66 22.18 15.60 26.60

schemes and comparisons are always

made between the relative merits and Edelweiss Tokio NA NA 25.96 25.58 29.87

demerits of ULIPs and Mutual Fund Exide Life 29 30.1 31.13 32.22 33.03

products. For all these reasons, sum Future Generali 8.88 16.61 20.46 22.08 22.61

assured available under ULIPs has little HDFC Life 31.78 41.36 50 47 47.2

value for the customers as they are ICICI Prudential 16.7 35.2 49.12 49.1 53.3

mostly eager to sell their units or

IDBI Federal 54.47 58.11 51.62 43.43 49.94

partially withdraw from the product as

soon as a satisfactory return is India First 37.3 26.01 26.01 35.78 33.63

obtained. We do not know too many Kotak Mahindra 25.75 37.39 45 47.2 46.64

persons who keep their ULIPs in force Max Life 23 37 46 47 49

upto the date of maturity. PNB MetLife 14 17.1 24.45 26.47 30.16

Reliance Nippon 6.42 16.17 31.4 32.97 36.14

Attachment to Insurance

Sahara India 22.09 40.05 40.05 32.38 33.14

Policies - Low SBI Life 16 23.44 37.19 38 42.28

Let us see how much attached are the Shriram 7 28.03 24.53 19.34 23.72

Indians to their life insurance policies.

Star Union Dai Ichi 19 21.4 22.5 42.85 42.74

If on an average a person takes a life

Tata AIA 16.39 24.02 3.22 32.74 37.97

insurance cover at the age of 25 or 30,

he is expected to keep these policies in LIC of India 44 44 44 43 51

force for at least 20 to 25 years. This Source: IRDAI Handbook 2018-19

should be so for all conventional

policies, protection type or savings Since Persistency Ratio is extremely important for the insurers of the industry,

type. IRDAI publishes Persistency we look at the Persistency performance of all the insurers. We can jot down the

Ratios of insurers at 13,25,37,49 and important facts about the Persistency as under:

61 month stages. For both the insurers Y It is a deplorable fact that for most of the insurers, the 61 month persistency

and insureds, it is important that the ratio is below 50%. To be precise, 20 out of 24 insurers have Persistency Ratios

policies are kept in force for a long time. below 50%. That means, after five years of policy terms, more than half the

policies go off the books either through lapsations or through surrenders or

Otherwise, there can be no utility of

even through death claims. The insurers who have the Persistency Ratio as

buying insurance policy. For insurers,

this is important because a policy starts on 31.03.2019 are marginally above the 50% mark. The policies either lapse

or get surrendered in most occasions as incidence of death claims is not too

giving some surplus to the insurers only

high as compared to other forms of exits. May be the policyholders prefer

if it runs for a minimum period of five

years. Table-5 gives the 61 month to go to other insurers or they may even start shunning life insurance and

put their investable surplus somewhere else.

persistency ratios of the life insurers

and the industry as on 31.03.2019. Y If we look at the figures closely, we find that most insurers have their current

The Insurance Times, October 2021 23