Page 39 - The Insurance Times October 2021

P. 39

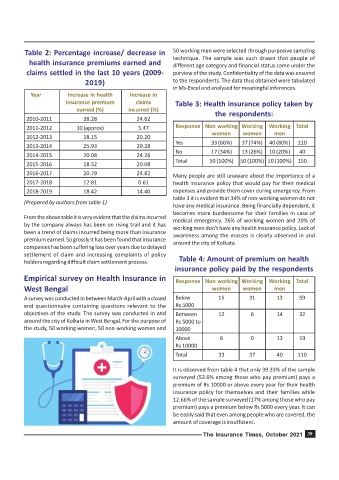

Table 2: Percentage increase/ decrease in 50 working men were selected through purposive sampling

technique. The sample was such drawn that people of

health insurance premiums earned and different age category and financial status came under the

claims settled in the last 10 years (2009- purview of the study. Confidentiality of the data was ensured

2019) to the respondents. The data thus obtained were tabulated

in Ms-Excel and analysed for meaningful inferences.

Year Increase in health Increase in

insurance premium claims Table 3: Health insurance policy taken by

earned (%) incurred (%)

the respondents:

2010-2011 38.28 24.62

2011-2012 10 (approx) 5.47 Response Non working Working Working Total

women women men

2012-2013 18.15 20.20

Yes 33 (66%) 37 (74%) 40 (80%) 110

2013-2014 25.93 29.28

No 17 (34%) 13 (26%) 10 (20%) 40

2014-2015 20.08 24.26

Total 50 (100%) 50 (100%) 50 (100%) 150

2015-2016 18.52 20.08

2016-2017 20.79 24.82

Many people are still unaware about the importance of a

2017-2018 12.81 0.61 health insurance policy that would pay for their medical

2018-2019 18.42 14.40 expenses and provide them cover during emergency. From

table 3 it is evident that 34% of non-working women do not

(Prepared by authors from table 1)

have any medical insurance. Being financially dependent, it

becomes more burdensome for their families in case of

From the above table it is very evident that the claims incurred medical emergency. 26% of working women and 20% of

by the company always has been on rising trail and it has

working men don't have any health insurance policy. Lack of

been a trend of claims incurred being more than insurance

awareness among the masses is clearly observed in and

premium earned. So grossly it has been found that insurance

around the city of Kolkata.

companies has been suffering loss over years due to delayed

settlement of claim and increasing complaints of policy

holders regarding difficult claim settlement process. Table 4: Amount of premium on health

insurance policy paid by the respondents

Empirical survey on Health Insurance in Response Non working Working Working Total

West Bengal women women men

A survey was conducted in between March-April with a closed Below 15 31 13 59

end questionnaire containing questions relevant to the Rs 5000

objectives of the study. The survey was conducted in and Between 12 6 14 32

around the city of Kolkata in West Bengal. For the purpose of Rs 5000 to

the study, 50 working women, 50 non-working women and 10000

Above 6 0 13 19

Rs 10000

Total 33 37 40 110

It is observed from table 4 that only 39.33% of the sample

surveyed (53.6% among those who pay premium) pays a

premium of Rs 10000 or above every year for their health

insurance policy for themselves and their families while

12.66% of the sample surveyed (17% among those who pay

premium) pays a premium below Rs 5000 every year. It can

be easily said that even among people who are covered, the

amount of coverage is insufficient.

The Insurance Times, October 2021 39