Page 38 - The Insurance Times October 2021

P. 38

hospital stay like room rent, nursing, boarding, cost of State of Health Insurance in India

medicines, ICU expenses, pre and post hospitalisation Health insurance has gained popularity among the middle

expenses, ambulance charges and expenses incurred to class and the elite class in India. Although the coverage and

avail medical treatment during home stay.

penetration is still very low when compared to other

Y Cashless treatment: Network hospitals which are developed nations, there has been a remarkable increase in

generally tied up with insurance companies provide its popularity among the masses. A concise picture of the

cashless treatment to the insured in the event of present state of health insurance in India for the past decade

hospitalisation. The insured can avail treatment in the is shown below:

hospital without making any payment for the medical

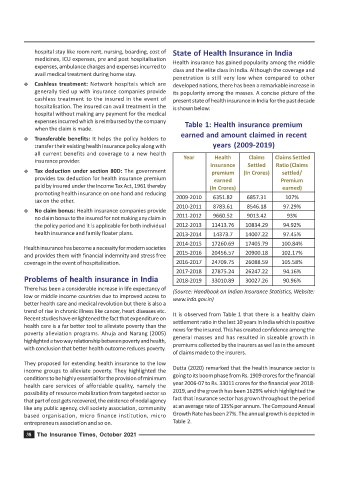

expenses incurred which is reimbursed by the company Table 1: Health insurance premium

when the claim is made.

earned and amount claimed in recent

Y Transferable benefits: It helps the policy holders to

transfer their existing health insurance policy along with years (2009-2019)

all current benefits and coverage to a new health

Year Health Claims Claims Settled

insurance provider.

insurance Settled Ratio (Claims

Y Tax deduction under section 80D: The government premium (In Crores) settled/

provides tax deduction for health insurance premium earned Premium

paid by insured under the Income Tax Act, 1961 thereby (In Crores) earned)

promoting health insurance on one hand and reducing 2009-2010 6351.82 6857.31 107%

tax on the other.

2010-2011 8783.61 8546.18 97.29%

Y No claim bonus: Health insurance companies provide

no claim bonus to the insured for not making any claim in 2011-2012 9660.52 9013.42 93%

the policy period and it is applicable for both individual 2012-2013 11413.76 10834.29 94.92%

health insurance and family floater plans. 2013-2014 14373.7 14007.22 97.45%

2014-2015 17260.69 17405.79 100.84%

Health insurance has become a necessity for modern societies

2015-2016 20456.57 20900.18 102.17%

and provides them with financial indemnity and stress free

coverage in the event of hospitalization. 2016-2017 24709.75 26088.59 105.58%

2017-2018 27875.24 26247.22 94.16%

Problems of health insurance in India 2018-2019 33010.89 30027.26 90.96%

There has been a considerable increase in life expectancy of (Source: Handbook on Indian Insurance Statistics, Website:

low or middle income countries due to improved access to www.irda.gov.in)

better health care and medical revolution but there is also a

trend of rise in chronic illness like cancer, heart diseases etc. It is observed from Table 1 that there is a healthy claim

Recent studies have enlightened the fact that expenditure on settlement ratio in the last 10 years in India which is positive

health care is a far better tool to alleviate poverty than the

poverty alleviation programs. Ahuja and Narang (2005) news for the insured. This has created confidence among the

highlighted a two way relationship between poverty and health, general masses and has resulted in sizeable growth in

premiums collected by the insurers as well as in the amount

with conclusion that better health outcome reduces poverty.

of claims made to the insurers.

They proposed for extending health insurance to the low

income groups to alleviate poverty. They highlighted the Dutta (2020) remarked that the health insurance sector is

conditions to be highly essential for the provision of minimum going to its boom phase from Rs. 1909 crores for the financial

year 2006-07 to Rs. 33011 crores for the financial year 2018-

health care services of affordable quality, namely the

possibility of resource mobilization from targeted sector so 2019, and the growth has been 1629% which highlighted the

that part of cost gets recovered, the existence of nodal agency fact that insurance sector has grown throughout the period

like any public agency, civil society association, community at an average rate of 135% per annum. The Compound Annual

based organisation, micro finance institution, micro Growth Rate has been 27%. The annual growth is depicted in

entrepreneurs association and so on. Table 2.

38 The Insurance Times, October 2021