Page 22 - Las Vegas LVQR Market Research Report Q1 2024

P. 22

Colliers 5

Retail

Las Vegas 24Q1

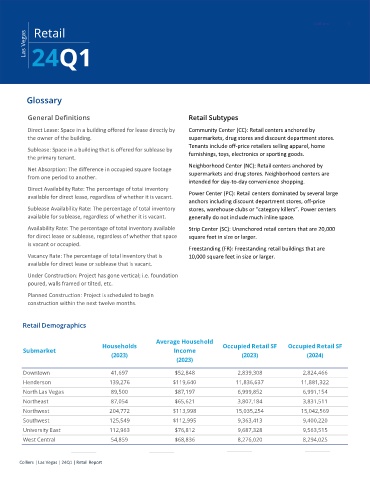

Glossary

General Definitions Retail Subtypes

Direct Lease: Space in a building offered for lease directly by Community Center (CC): Retail centers anchored by

the owner of the building. supermarkets, drug stores and discount department stores.

Tenants include off-price retailers selling apparel, home

Sublease: Space in a building that is offered for sublease by

furnishings, toys, electronics or sporting goods.

the primary tenant.

Neighborhood Center (NC): Retail centers anchored by

Net Absorption: The difference in occupied square footage

supermarkets and drug stores. Neighborhood centers are

from one period to another.

intended for day-to-day convenience shopping.

Direct Availability Rate: The percentage of total inventory

Power Center (PC): Retail centers dominated by several large

available for direct lease, regardless of whether it is vacant.

anchors including discount department stores, off-price

Sublease Availability Rate: The percentage of total inventory stores, warehouse clubs or “category killers”. Power centers

available for sublease, regardless of whether it is vacant. generally do not include much inline space.

Availability Rate: The percentage of total inventory available Strip Center (SC): Unanchored retail centers that are 20,000

for direct lease or sublease, regardless of whether that space square feet in size or larger.

is vacant or occupied.

Freestanding (FR): Freestanding retail buildings that are

Vacancy Rate: The percentage of total inventory that is 10,000 square feet in size or larger.

available for direct lease or sublease that is vacant.

Under Construction: Project has gone vertical; i.e. foundation

poured, walls framed or tilted, etc.

Planned Construction: Project is scheduled to begin

construction within the next twelve months.

Retail Demographics

Average Household

Households Occupied Retail SF Occupied Retail SF

Submarket Income

(2023) (2023) (2024)

(2023)

Downtown 41,697 $52,848 2,839,308 2,824,466

Henderson 139,276 $119,640 11,836,637 11,881,322

North Las Vegas 89,500 $87,197 6,999,852 6,991,154

Northeast 87,054 $65,621 3,807,184 3,831,511

Northwest 204,772 $113,998 15,035,254 15,042,569

Southwest 125,549 $112,995 9,363,413 9,400,220

University East 112,963 $76,812 9,687,328 9,563,515

West Central 54,859 $68,836 8,276,020 8,294,025

Colliers | Las Vegas | 24Q1 | Retail Report