Page 17 - AB Mauri 2022 Benefits Guide MOIL

P. 17

2022 Benefits Enrollment

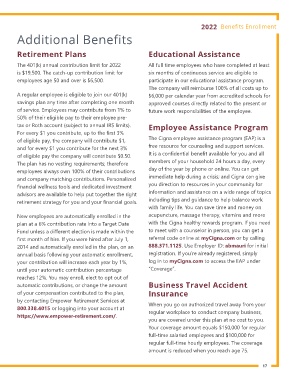

Additional Benefits

Retirement Plans Educational Assistance

The 401(k) annual contribution limit for 2022 All full time employees who have completed at least

is $19,500. The catch-up contribution limit for six months of continuous service are eligible to

employees age 50 and over is $6,500. participate in our educational assistance program.

The company will reimburse 100% of all costs up to

A regular employee is eligible to join our 401(k) $6,000 per calendar year from accredited schools for

savings plan any time after completing one month approved courses directly related to the present or

of service. Employees may contribute from 1% to future work responsibilities of the employee.

50% of their eligible pay to their employee pre-

tax or Roth account (subject to annual IRS limits). Employee Assistance Program

For every $1 you contribute, up to the irst 3%

of eligible pay, the company will contribute $1, The Cigna employee assistance program (EAP) is a

and for every $1 you contribute for the next 3% free resource for counseling and support services.

of eligible pay the company will contribute $0.50. It is a conidential beneit available for you and all

The plan has no vesting requirements; therefore members of your household 24 hours a day, every

employees always own 100% of their contributions day of the year by phone or online. You can get

and company matching contributions. Personalized immediate help during a crisis; and Cigna can give

inancial wellness tools and dedicated investment you direction to resources in your community for

advisors are available to help put together the right information and assistance on a wide range of topics

retirement strategy for you and your inancial goals. including tips and guidance to help balance work

with family life. You can save time and money on

New employees are automatically enrolled in the acupuncture, massage therapy, vitamins and more

plan at a 6% contribution rate into a Target Date with the Cigna healthy rewards program. If you need

Fund unless a diferent election is made within the to meet with a counselor in person, you can get a

irst month of hire. If you were hired after July 1, referral code online at myCigna.com or by calling

2014 and automatically enrolled in the plan, on an 888.371.1125. Use Employer ID: abmauri for initial

annual basis following your automatic enrollment, registration. If you’re already registered, simply

your contribution will increase each year by 1%, log in to myCigna.com to access the EAP under

until your automatic contribution percentage “Coverage”.

reaches 12%. You may enroll, elect to opt out of

automatic contributions, or change the amount Business Travel Accident

of your compensation contributed to the plan, Insurance

by contacting Empower Retirement Services at When you go on authorized travel away from your

800.338.4015 or logging into your account at regular workplace to conduct company business,

https://www.empower-retirement.com/.

you are covered under this plan at no cost to you.

Your coverage amount equals $150,000 for regular

full-time salaried employees and $100,000 for

regular full-time hourly employees. The coverage

amount is reduced when you reach age 75.

17

Additional Benefits

Retirement Plans Educational Assistance

The 401(k) annual contribution limit for 2022 All full time employees who have completed at least

is $19,500. The catch-up contribution limit for six months of continuous service are eligible to

employees age 50 and over is $6,500. participate in our educational assistance program.

The company will reimburse 100% of all costs up to

A regular employee is eligible to join our 401(k) $6,000 per calendar year from accredited schools for

savings plan any time after completing one month approved courses directly related to the present or

of service. Employees may contribute from 1% to future work responsibilities of the employee.

50% of their eligible pay to their employee pre-

tax or Roth account (subject to annual IRS limits). Employee Assistance Program

For every $1 you contribute, up to the irst 3%

of eligible pay, the company will contribute $1, The Cigna employee assistance program (EAP) is a

and for every $1 you contribute for the next 3% free resource for counseling and support services.

of eligible pay the company will contribute $0.50. It is a conidential beneit available for you and all

The plan has no vesting requirements; therefore members of your household 24 hours a day, every

employees always own 100% of their contributions day of the year by phone or online. You can get

and company matching contributions. Personalized immediate help during a crisis; and Cigna can give

inancial wellness tools and dedicated investment you direction to resources in your community for

advisors are available to help put together the right information and assistance on a wide range of topics

retirement strategy for you and your inancial goals. including tips and guidance to help balance work

with family life. You can save time and money on

New employees are automatically enrolled in the acupuncture, massage therapy, vitamins and more

plan at a 6% contribution rate into a Target Date with the Cigna healthy rewards program. If you need

Fund unless a diferent election is made within the to meet with a counselor in person, you can get a

irst month of hire. If you were hired after July 1, referral code online at myCigna.com or by calling

2014 and automatically enrolled in the plan, on an 888.371.1125. Use Employer ID: abmauri for initial

annual basis following your automatic enrollment, registration. If you’re already registered, simply

your contribution will increase each year by 1%, log in to myCigna.com to access the EAP under

until your automatic contribution percentage “Coverage”.

reaches 12%. You may enroll, elect to opt out of

automatic contributions, or change the amount Business Travel Accident

of your compensation contributed to the plan, Insurance

by contacting Empower Retirement Services at When you go on authorized travel away from your

800.338.4015 or logging into your account at regular workplace to conduct company business,

https://www.empower-retirement.com/.

you are covered under this plan at no cost to you.

Your coverage amount equals $150,000 for regular

full-time salaried employees and $100,000 for

regular full-time hourly employees. The coverage

amount is reduced when you reach age 75.

17