Page 13 - AB Mauri 2022 Benefits Guide MOIL

P. 13

2022 Benefits Enrollment

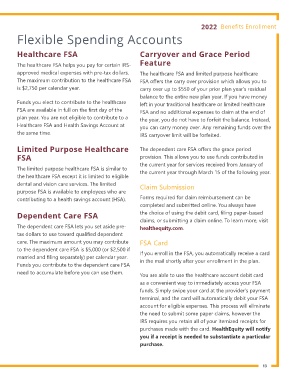

Flexible Spending Accounts

Healthcare FSA Carryover and Grace Period

The healthcare FSA helps you pay for certain IRS- Feature

approved medical expenses with pre-tax dollars. The healthcare FSA and limited purpose healthcare

The maximum contribution to the healthcare FSA FSA ofers the carry over provision which allows you to

is $2,750 per calendar year. carry over up to $550 of your prior plan year’s residual

balance to the entire new plan year. If you have money

Funds you elect to contribute to the healthcare left in your traditional healthcare or limited healthcare

FSA are available in full on the irst day of the FSA and no additional expenses to claim at the end of

plan year. You are not eligible to contribute to a the year, you do not have to forfeit the balance. Instead,

Healthcare FSA and Health Savings Account at you can carry money over. Any remaining funds over the

the same time. IRS carryover limit will be forfeited.

Limited Purpose Healthcare The dependent care FSA ofers the grace period

FSA provision. This allows you to use funds contributed in

the current year for services received from January of

The limited purpose healthcare FSA is similar to the current year through March 15 of the following year.

the healthcare FSA except it is limited to eligible

dental and vision care services. The limited Claim Submission

purpose FSA is available to employees who are

contributing to a health savings account (HSA). Forms required for claim reimbursement can be

completed and submitted online. You always have

Dependent Care FSA the choice of using the debit card, iling paper-based

claims, or submitting a claim online. To learn more, visit

The dependent care FSA lets you set aside pre- healthequity.com.

tax dollars to use toward qualiied dependent

care. The maximum amount you may contribute FSA Card

to the dependent care FSA is $5,000 (or $2,500 if If you enroll in the FSA, you automatically receive a card

married and iling separately) per calendar year. in the mail shortly after your enrollment in the plan.

Funds you contribute to the dependent care FSA

need to accumulate before you can use them. You are able to use the healthcare account debit card

as a convenient way to immediately access your FSA

funds. Simply swipe your card at the provider’s payment

terminal, and the card will automatically debit your FSA

account for eligible expenses. This process will eliminate

the need to submit some paper claims, however the

IRS requires you retain all of your itemized receipts for

purchases made with the card. HealthEquity will notify

you if a receipt is needed to substantiate a particular

purchase.

13

Flexible Spending Accounts

Healthcare FSA Carryover and Grace Period

The healthcare FSA helps you pay for certain IRS- Feature

approved medical expenses with pre-tax dollars. The healthcare FSA and limited purpose healthcare

The maximum contribution to the healthcare FSA FSA ofers the carry over provision which allows you to

is $2,750 per calendar year. carry over up to $550 of your prior plan year’s residual

balance to the entire new plan year. If you have money

Funds you elect to contribute to the healthcare left in your traditional healthcare or limited healthcare

FSA are available in full on the irst day of the FSA and no additional expenses to claim at the end of

plan year. You are not eligible to contribute to a the year, you do not have to forfeit the balance. Instead,

Healthcare FSA and Health Savings Account at you can carry money over. Any remaining funds over the

the same time. IRS carryover limit will be forfeited.

Limited Purpose Healthcare The dependent care FSA ofers the grace period

FSA provision. This allows you to use funds contributed in

the current year for services received from January of

The limited purpose healthcare FSA is similar to the current year through March 15 of the following year.

the healthcare FSA except it is limited to eligible

dental and vision care services. The limited Claim Submission

purpose FSA is available to employees who are

contributing to a health savings account (HSA). Forms required for claim reimbursement can be

completed and submitted online. You always have

Dependent Care FSA the choice of using the debit card, iling paper-based

claims, or submitting a claim online. To learn more, visit

The dependent care FSA lets you set aside pre- healthequity.com.

tax dollars to use toward qualiied dependent

care. The maximum amount you may contribute FSA Card

to the dependent care FSA is $5,000 (or $2,500 if If you enroll in the FSA, you automatically receive a card

married and iling separately) per calendar year. in the mail shortly after your enrollment in the plan.

Funds you contribute to the dependent care FSA

need to accumulate before you can use them. You are able to use the healthcare account debit card

as a convenient way to immediately access your FSA

funds. Simply swipe your card at the provider’s payment

terminal, and the card will automatically debit your FSA

account for eligible expenses. This process will eliminate

the need to submit some paper claims, however the

IRS requires you retain all of your itemized receipts for

purchases made with the card. HealthEquity will notify

you if a receipt is needed to substantiate a particular

purchase.

13