Page 480 - Business Principles and Management

P. 480

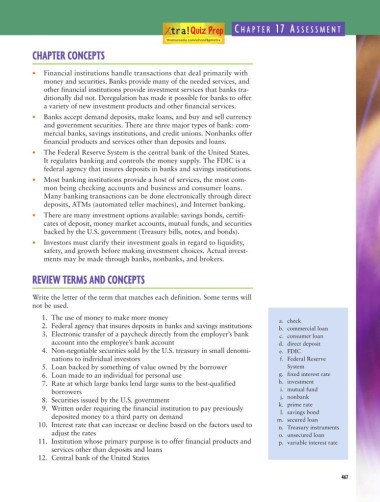

C HAPTER 17 A SSESSMENT

thomsonedu.com/school/bpmxtra

CHAPTER CONCEPTS

• Financial institutions handle transactions that deal primarily with

money and securities. Banks provide many of the needed services, and

other financial institutions provide investment services that banks tra-

ditionally did not. Deregulation has made it possible for banks to offer

a variety of new investment products and other financial services.

• Banks accept demand deposits, make loans, and buy and sell currency

and government securities. There are three major types of bank: com-

mercial banks, savings institutions, and credit unions. Nonbanks offer

financial products and services other than deposits and loans.

• The Federal Reserve System is the central bank of the United States.

It regulates banking and controls the money supply. The FDIC is a

federal agency that insures deposits in banks and savings institutions.

• Most banking institutions provide a host of services, the most com-

mon being checking accounts and business and consumer loans.

Many banking transactions can be done electronically through direct

deposits, ATMs (automated teller machines), and Internet banking.

• There are many investment options available: savings bonds, certifi-

cates of deposit, money market accounts, mutual funds, and securities

backed by the U.S. government (Treasury bills, notes, and bonds).

• Investors must clarify their investment goals in regard to liquidity,

safety, and growth before making investment choices. Actual invest-

ments may be made through banks, nonbanks, and brokers.

REVIEW TERMS AND CONCEPTS

Write the letter of the term that matches each definition. Some terms will

not be used.

1. The use of money to make more money

a. check

2. Federal agency that insures deposits in banks and savings institutions

b. commercial loan

3. Electronic transfer of a paycheck directly from the employer’s bank c. consumer loan

account into the employee’s bank account d. direct deposit

4. Non-negotiable securities sold by the U.S. treasury in small denomi- e. FDIC

nations to individual investors f. Federal Reserve

5. Loan backed by something of value owned by the borrower System

6. Loan made to an individual for personal use g. fixed interest rate

7. Rate at which large banks lend large sums to the best-qualified h. investment

borrowers i. mutual fund

j. nonbank

8. Securities issued by the U.S. government

k. prime rate

9. Written order requiring the financial institution to pay previously

l. savings bond

deposited money to a third party on demand

m. secured loan

10. Interest rate that can increase or decline based on the factors used to

n. Treasury instruments

adjust the rates o. unsecured loan

11. Institution whose primary purpose is to offer financial products and p. variable interest rate

services other than deposits and loans

12. Central bank of the United States

467