Page 481 - Business Principles and Management

P. 481

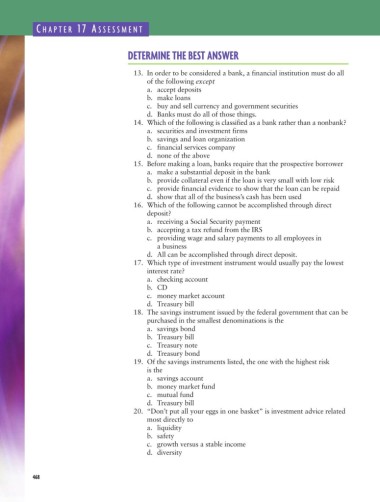

C HAPTER 17 A SSESSMENT

DETERMINE THE BEST ANSWER

13. In order to be considered a bank, a financial institution must do all

of the following except

a. accept deposits

b. make loans

c. buy and sell currency and government securities

d. Banks must do all of those things.

14. Which of the following is classified as a bank rather than a nonbank?

a. securities and investment firms

b. savings and loan organization

c. financial services company

d. none of the above

15. Before making a loan, banks require that the prospective borrower

a. make a substantial deposit in the bank

b. provide collateral even if the loan is very small with low risk

c. provide financial evidence to show that the loan can be repaid

d. show that all of the business’s cash has been used

16. Which of the following cannot be accomplished through direct

deposit?

a. receiving a Social Security payment

b. accepting a tax refund from the IRS

c. providing wage and salary payments to all employees in

a business

d. All can be accomplished through direct deposit.

17. Which type of investment instrument would usually pay the lowest

interest rate?

a. checking account

b. CD

c. money market account

d. Treasury bill

18. The savings instrument issued by the federal government that can be

purchased in the smallest denominations is the

a. savings bond

b. Treasury bill

c. Treasury note

d. Treasury bond

19. Of the savings instruments listed, the one with the highest risk

is the

a. savings account

b. money market fund

c. mutual fund

d. Treasury bill

20. “Don’t put all your eggs in one basket” is investment advice related

most directly to

a. liquidity

b. safety

c. growth versus a stable income

d. diversity

468