Page 661 - Business Principles and Management

P. 661

Unit 7

working. Retirement plans are designed to meet that need. A pension plan is a

company-sponsored retirement plan that makes regular payments to employees

after retirement. Companies with a pension plan put a percentage of employees’

salaries into a pension fund. The money is invested and earnings are used to make

pension payments to retired employees. In a few pension plans, the employer

makes the entire contribution, but in most plans the employee makes a contri-

bution as well or pays the entire cost of the contribution. Employee contribu-

tions to many retirement plans can be tax-deferred, meaning the contribution

is made before taxes are calculated on the employee’s income. Tax deferment

reduces the amount of income taxes to be paid. When the employee retires,

benefits received are taxed, but usually at a lower rate than when the contri-

bution was made. Figure 24-2 summarizes the differences among common

types of retirement plans.

VACATIONS AND TIME OFF After employees have worked for a company for a speci-

fied time, often one year, they may begin to earn vacation days. Most companies

pay the employees’ regular salary during vacations. In addition to earned vaca-

tions, some companies are closed for holidays and may pay their employees for

those days. Other common benefits are paid or unpaid absences for personal ill-

ness, the illness or death of family members, and the birth or adoption of a child.

REQUIRED BENEFITS Federal and state laws require companies to offer a number

of benefits to employees, including Social Security and Medicare contributions,

workers’ compensation, and unemployment insurance. Companies employing

50 or more people must offer unpaid family and medical leave. These benefits

were described in Chapter 23.

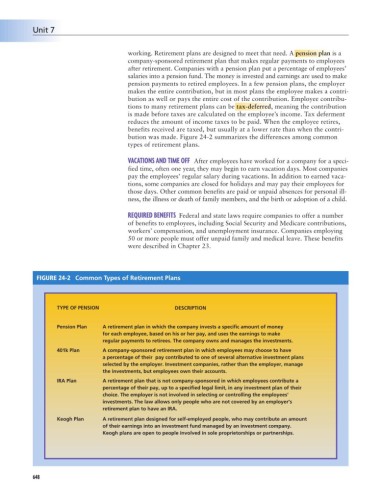

FIGURE 24-2 Common Types of Retirement Plans

TYPE OF PENSION DESCRIPTION

Pension Plan A retirement plan in which the company invests a specific amount of money

for each employee, based on his or her pay, and uses the earnings to make

regular payments to retirees. The company owns and manages the investments.

401k Plan A company-sponsored retirement plan in which employees may choose to have

a percentage of their pay contributed to one of several alternative investment plans

selected by the employer. Investment companies, rather than the employer, manage

the investments, but employees own their accounts.

IRA Plan A retirement plan that is not company-sponsored in which employees contribute a

percentage of their pay, up to a specified legal limit, in any investment plan of their

choice. The employer is not involved in selecting or controlling the employees’

investments. The law allows only people who are not covered by an employer’s

retirement plan to have an IRA.

Keogh Plan A retirement plan designed for self-employed people, who may contribute an amount

of their earnings into an investment fund managed by an investment company.

Keogh plans are open to people involved in sole proprietorships or partnerships.

648