Page 671 - Business Principles and Management

P. 671

C HAPTER 24 A SSESSMENT

thomsonedu.com/school/bpmxtra

CHAPTER CONCEPTS

• Factors that affect the amount of pay an employee receives include the

skill required for the job, working conditions, education and experience,

supply and demand for that type of worker, and economic conditions.

• Companies develop compensation plans to determine how employees

will be paid. Common compensation plans are time plans, performance

plans, and combination plans.

• Companies may choose to provide a range of employee benefits in

addition to wages. Employers must be sure that compensation plans

meet all federal and state laws.

• On average, companies spend between 20 and 40 percent of employee

wages and salaries for benefits. Customary benefits include insurance,

retirement plans, vacations and time off, as well as benefits required

by law.

• Performance reviews assess how well employees are doing their jobs.

Procedures should be followed for evaluation as well as for possible

penalties or termination.

• The large amount of money companies spend on formal and informal

training can be justified if the result is more effective and productive

employees.

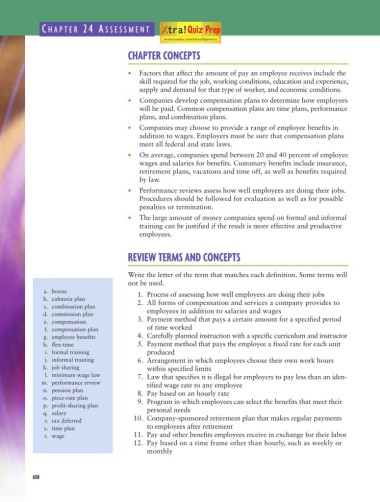

REVIEW TERMS AND CONCEPTS

Write the letter of the term that matches each definition. Some terms will

not be used.

a. bonus 1. Process of assessing how well employees are doing their jobs

b. cafeteria plan 2. All forms of compensation and services a company provides to

c. combination plan

d. commission plan employees in addition to salaries and wages

e. compensation 3. Payment method that pays a certain amount for a specified period

f. compensation plan of time worked

g. employee benefits 4. Carefully planned instruction with a specific curriculum and instructor

h. flex-time 5. Payment method that pays the employee a fixed rate for each unit

i. formal training produced

j. informal training 6. Arrangement in which employees choose their own work hours

k. job sharing within specified limits

l. minimum wage law 7. Law that specifies it is illegal for employers to pay less than an iden-

m. performance review tified wage rate to any employee

n. pension plan 8. Pay based on an hourly rate

o. piece-rate plan 9. Program in which employees can select the benefits that meet their

p. profit-sharing plan personal needs

q. salary

r. tax deferred 10. Company-sponsored retirement plan that makes regular payments

s. time plan to employees after retirement

t. wage 11. Pay and other benefits employees receive in exchange for their labor

12. Pay based on a time frame other than hourly, such as weekly or

monthly

658