Page 306 - Using MIS

P. 306

274 Chapter 7 Processes, Organizations, and Information Systems

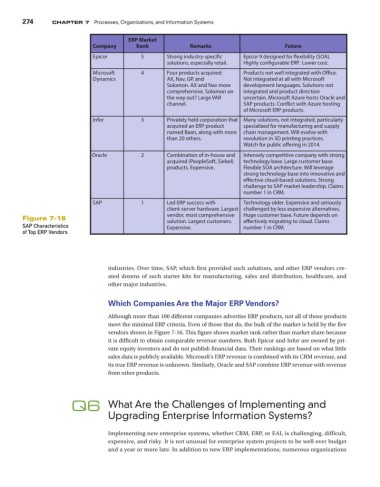

ERP Market

Company Rank Remarks Future

Epicor 5 Strong industry-specic Epicor 9 designed for exibility (SOA).

solutions, especially retail. Highly congurable ERP. Lower cost.

Microsoft 4 Four products acquired: Products not well integrated with Oce.

Dynamics AX, Nav, GP, and Not integrated at all with Microsoft

Solomon. AX and Nav more development languages. Solutions not

comprehensive. Solomon on integrated and product direction

the way out? Large VAR uncertain. Microsoft Azure hosts Oracle and

channel. SAP products. Conict with Azure hosting

of Microsoft ERP products.

Infor 3 Privately held corporation that Many solutions, not integrated, particularly

acquired an ERP product specialized for manufacturing and supply

named Baan, along with more chain management. Will evolve with

than 20 others. revolution in 3D printing practices.

Watch for public oering in 2014.

Oracle 2 Combination of in-house and Intensely competitive company with strong

acquired (PeopleSoft, Siebel) technology base. Large customer base.

products. Expensive. Flexible SOA architecture. Will leverage

strong technology base into innovative and

eective cloud-based solutions. Strong

challenge to SAP market leadership. Claims

number 1 in CRM.

SAP 1 Led ERP success with Technology older. Expensive and seriously

client-server hardware. Largest challenged by less expensive alternatives.

vendor, most comprehensive Huge customer base. Future depends on

Figure 7-16 solution. Largest customers. eectively migrating to cloud. Claims

SAP Characteristics Expensive. number 1 in CRM.

of Top ERP Vendors

industries. Over time, SAP, which first provided such solutions, and other ERP vendors cre-

ated dozens of such starter kits for manufacturing, sales and distribution, healthcare, and

other major industries.

Which Companies Are the Major ERP Vendors?

Although more than 100 different companies advertise ERP products, not all of those products

meet the minimal ERP criteria. Even of those that do, the bulk of the market is held by the five

vendors shown in Figure 7-16. This figure shows market rank rather than market share because

it is difficult to obtain comparable revenue numbers. Both Epicor and Infor are owned by pri-

vate equity investors and do not publish financial data. Their rankings are based on what little

sales data is publicly available. Microsoft’s ERP revenue is combined with its CRM revenue, and

its true ERP revenue is unknown. Similarly, Oracle and SAP combine ERP revenue with revenue

from other products.

Q6 What Are the Challenges of Implementing and

Upgrading Enterprise Information Systems?

Implementing new enterprise systems, whether CRM, ERP, or EAI, is challenging, difficult,

expensive, and risky. It is not unusual for enterprise system projects to be well over budget

and a year or more late. In addition to new ERP implementations, numerous organizations