Page 669 - Introduction to Business

P. 669

APPENDIX A-3

Chrysler acquired a 10.5 percent stake in Hyundai onsite outsourcing), sharing of parts, and pooling of

Motors of South Korea, which it resold in August 2004. It purchasing to reduce cost and improve quality at the

now works with Hyundai as a strategic partner on a same time? Finally, what will be DaimlerChrysler’s strat-

project-by-project basis. egy to effectively meet the Lexus-Toyota (the benchmark

for automotive quality and service) challenge in the

CHALLENGES AHEAD world market? While sustained profitability has been a

With DaimlerChrysler shares losing about two-thirds of challenge for DaimlerChrysler since the merger in 1998,

their value since the merger, one could argue whether or positive developments especially at the Chrysler divi-

not the deal was a mistake. Industry analysts have raised sion provide hope for a better future.

several issues. First, can a luxury automobile manufac-

turer (Daimler-Benz) effectively integrate its operations Sources: www.daimlerchrysler.com/dccom (Home; Daily

with mass-market manufacturers to produce Chairman News; Investor Relations; Top Stories; Special Reports); and Jay

Jürgen Schrempp’s “Welt AG”—a truly global company? P. Pedersen, Ed., DaimlerChrysler, International Directory of

Second, can the relatively weak brand image of Chrysler Company Histories, [Chicago: St. James Press, c 2000] Vol. 34,

pp. 128–137.

and quality problems at Mitsubishi be overcome by

infusing new manufacturing techniques (for example,

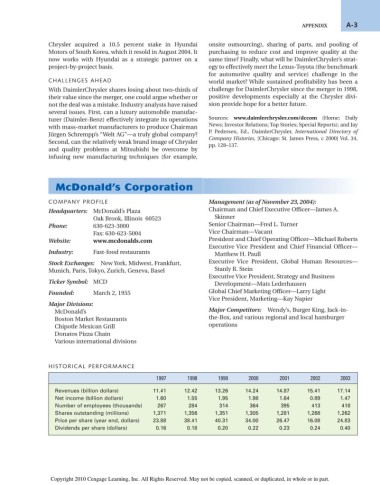

McDonald’s Corporation

COMPANY PROFILE Management (as of November 23, 2004):

Headquarters: McDonald’s Plaza Chairman and Chief Executive Officer—James A.

Oak Brook, Illinois 60523 Skinner

Phone: 630-623-3000 Senior Chairman—Fred L. Turner

Fax: 630-623-5004 Vice Chairman—Vacant

Website: www.mcdonalds.com President and Chief Operating Officer—Michael Roberts

Executive Vice President and Chief Financial Officer—

Industry: Fast-food restaurants Matthew H. Paull

Stock Exchanges: New York, Midwest, Frankfurt, Executive Vice President, Global Human Resources—

Munich, Paris, Tokyo, Zurich, Geneva, Basel Stanly R. Stein

Executive Vice President, Strategy and Business

Ticker Symbol: MCD Development—Mats Lederhausen

Founded: March 2, 1955 Global Chief Marketing Officer—Larry Light

Vice President, Marketing—Kay Napier

Major Divisions:

McDonald’s Major Competitors: Wendy’s, Burger King, Jack-in-

Boston Market Restaurants the-Box, and various regional and local hamburger

Chipotle Mexican Grill operations

Donatos Pizza Chain

Various international divisions

HISTORICAL PERFORMANCE

1997 1998 1999 2000 2001 2002 2003

Revenues (billion dollars) 11.41 12.42 13.26 14.24 14.87 15.41 17.14

Net income (billion dollars) 1.60 1.55 1.95 1.98 1.64 0.89 1.47

Number of employees (thousands) 267 284 314 364 395 413 418

Shares outstanding (millions) 1,371 1,356 1,351 1,305 1,281 1,268 1,262

Price per share (year end, dollars) 23.88 38.41 40.31 34.00 26.47 16.08 24.83

Dividends per share (dollars) 0.16 0.18 0.20 0.22 0.23 0.24 0.40

Copyright 2010 Cengage Learning, Inc. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part.