Page 13 - CCFA Journal - 12th Issue

P. 13

加中金融 Markets 市场观察

历史上美国实际利率趋势性上行发生在 1919 年、1946 年 Historically, actual interest rate trends in the US rose in 1919,

和 1979 年。前两个时间段对应两次大战结束后,全球人 1946 and 1979. The first two periods corresponded to the

口爆发式增长,是推动实际利率上升的主要原因;1979 end of the two world wars, when explosive global population

年更是计算机技术带来的信息化革命,促使劳动生产率 growth was the main driver of rising actual interest rates.

大幅提高。当下的人工智能还不能像当初计算机技术一 1979 saw the information revolution brought about by

样,在短时间内大幅提高整个社会的劳动生产率。而且 computer technology, which significantly improved labor

世界已经在经历结构性变化,去全球化下地缘政治风险 productivity. Current artificial intelligence cannot yet

甚至战争降低全球供应链效率,并和碳中和一起提高能 significantly improve the overall labor productivity of society

in a short period of time, like computer technology did back

源成本,美国加税增加投资和社会保障。虽然还看不到 then. Moreover, the world is undergoing structural changes -

恶性通胀,但 2%的目标可能需要随着世界改变了,持续 geopolitical risks and even wars have decreased due to

维持高位不安全也不现实。 deglobalization, lowering the efficiency of global supply

chains. At the same time, carbon neutralization is raising

美元指数的升值,有利于美国控制通胀,但对于其他国

家和地区,则是货币贬值和通胀压力,加大滞胀风险。 energy costs, as are US tax increases on investment and social

中国人民银行表示“金融管理部门有能力、有信心、有 welfare. While hyper-inflation is still not visible, the 2% target

条件保持人民币汇率基本稳定”,“坚决防范汇率超调 may also need adjustments as the world environment evolves.

风险”。决定 9 月 15 日起,金融机构外汇存款准备金率 The strengthening of the US dollar is conducive to controlling

由现行的 6%下调至 4%。 inflation in the US, but for other countries and regions, it

means currency depreciation and inflationary pressure,

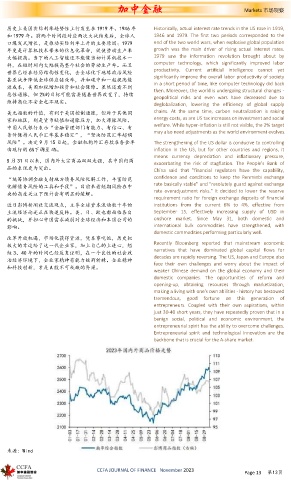

5 月 31 日以来,国内外大宗商品双双走强,其中国内商 exacerbating the risk of stagflation. The People's Bank of

品的表现更为突出。 China said that "financial regulators have the capability,

confidence and conditions to keep the Renminbi exchange

“统筹协调金融支持地方债务风险化解工作,丰富防范

化解债务风险的工具和手段”。目前来看短期风险在中 rate basically stable" and "resolutely guard against exchange

央的高度关注下预计会有明显的缓解。 rate overadjustment risks." It decided to lower the reserve

requirement ratio for foreign exchange deposits of financial

近日彭博新闻社交流观点,主导全球资本流动数十年的 institutions from the current 6% to 4%, effective from

主流经济论述正在快速反转。美、日、欧也都面临各自 September 15, effectively increasing supply of USD in

的挑战,并担心中国需求减弱对全球经济和本国公司的 onshore market. Since May 31, both domestic and

影响。 international bulk commodities have strengthened, with

domestic commodities performing particularly well.

改革开放机遇,市场化获得资源,凭本事吃饭,历史把

极大的幸运给了这一代企业家,加上自己的上进心,短 Recently Bloomberg reported that mainstream economic

短 3、40 年的时间已经反复证明,在一个良性的社会政 narratives that have dominated global capital flows for

治经济环境下,企业家精神有能力披荆斩棘。企业精神 decades are rapidly reversing. The US, Japan and Europe also

face their own challenges and worry about the impact of

和科技创新,才是 A 股不可或缺的脊梁。

weaker Chinese demand on the global economy and their

domestic companies. The opportunities of reform and

opening-up, obtaining resources through marketization,

making a living with one's own abilities - history has bestowed

tremendous, good fortune on this generation of

entrepreneurs. Coupled with their own aspirations, within

just 30-40 short years, they have repeatedly proven that in a

benign social, political and economic environment, the

entrepreneurial spirit has the ability to overcome challenges.

Entrepreneurial spirit and technological innovation are the

backbone that is crucial for the A-share market.

来源:Wind

CCFA JOURNAL OF FINANCE November 2023 Page 13 第13页