Page 254 - BA2 Integrated Workbook - Student 2017

P. 254

Fundamentals of Management Accounting

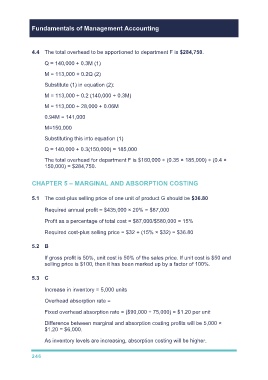

4.4 The total overhead to be apportioned to department F is $284,750.

Q = 140,000 + 0.3M (1)

M = 113,000 + 0.2Q (2)

Substitute (1) in equation (2):

M = 113,000 + 0.2 (140,000 + 0.3M)

M = 113,000 + 28,000 + 0.06M

0.94M = 141,000

M=150,000

Substituting this into equation (1)

Q = 140,000 + 0.3(150,000) = 185,000

The total overhead for department F is $160,000 + (0.35 × 185,000) + (0.4 ×

150,000) = $284,750.

CHAPTER 5 – MARGINAL AND ABSORPTION COSTING

5.1 The cost-plus selling price of one unit of product G should be $36.80

Required annual profit = $435,000 × 20% = $87,000

Profit as a percentage of total cost = $87,000/$580,000 = 15%

Required cost-plus selling price = $32 + (15% × $32) = $36.80

5.2 B

If gross profit is 50%, unit cost is 50% of the sales price. If unit cost is $50 and

selling price is $100, then it has been marked up by a factor of 100%.

5.3 C

Increase in inventory = 5,000 units

Overhead absorption rate =

Fixed overhead absorption rate = ($90,000 ÷ 75,000) = $1.20 per unit

Difference between marginal and absorption costing profits will be 5,000 ×

$1.20 = $6,000.

As inventory levels are increasing, absorption costing will be higher.

246