Page 4 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 4

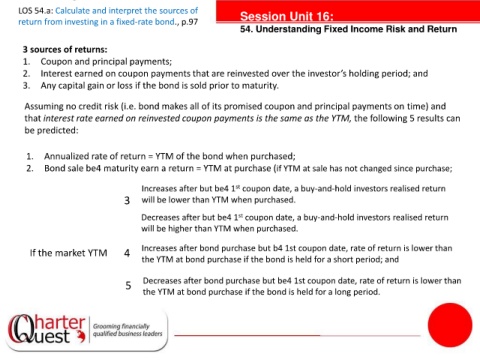

LOS 54.a: Calculate and interpret the sources of Session Unit 16:

return from investing in a fixed-rate bond., p.97

54. Understanding Fixed Income Risk and Return

3 sources of returns:

1. Coupon and principal payments;

2. Interest earned on coupon payments that are reinvested over the investor’s holding period; and

3. Any capital gain or loss if the bond is sold prior to maturity.

Assuming no credit risk (i.e. bond makes all of its promised coupon and principal payments on time) and

that interest rate earned on reinvested coupon payments is the same as the YTM, the following 5 results can

be predicted:

tanties

1. Annualized rate of return = YTM of the bond when purchased;

2. Bond sale be4 maturity earn a return = YTM at purchase (if YTM at sale has not changed since purchase;

st

Increases after but be4 1 coupon date, a buy-and-hold investors realised return

3 will be lower than YTM when purchased.

st

Decreases after but be4 1 coupon date, a buy-and-hold investors realised return

will be higher than YTM when purchased.

Increases after bond purchase but b4 1st coupon date, rate of return is lower than

If the market YTM 4

the YTM at bond purchase if the bond is held for a short period; and

5 Decreases after bond purchase but be4 1st coupon date, rate of return is lower than

the YTM at bond purchase if the bond is held for a long period.