Page 7 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 7

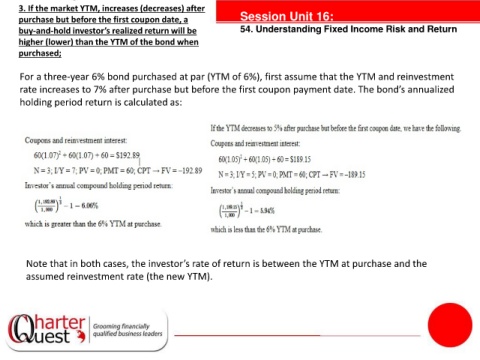

3. If the market YTM, increases (decreases) after

purchase but before the first coupon date, a Session Unit 16:

buy-and-hold investor’s realized return will be 54. Understanding Fixed Income Risk and Return

higher (lower) than the YTM of the bond when

purchased;

For a three-year 6% bond purchased at par (YTM of 6%), first assume that the YTM and reinvestment

rate increases to 7% after purchase but before the first coupon payment date. The bond’s annualized

holding period return is calculated as:

tanties

Note that in both cases, the investor’s rate of return is between the YTM at purchase and the

assumed reinvestment rate (the new YTM).