Page 6 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 6

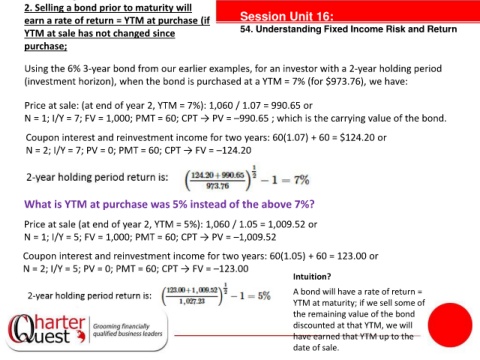

2. Selling a bond prior to maturity will

earn a rate of return = YTM at purchase (if Session Unit 16:

54. Understanding Fixed Income Risk and Return

YTM at sale has not changed since

purchase;

Using the 6% 3-year bond from our earlier examples, for an investor with a 2-year holding period

(investment horizon), when the bond is purchased at a YTM = 7% (for $973.76), we have:

Price at sale: (at end of year 2, YTM = 7%): 1,060 / 1.07 = 990.65 or

N = 1; I/Y = 7; FV = 1,000; PMT = 60; CPT → PV = –990.65 ; which is the carrying value of the bond.

Coupon interest and reinvestment income for two years: 60(1.07) + 60 = $124.20 or

tanties

N = 2; I/Y = 7; PV = 0; PMT = 60; CPT → FV = –124.20

What is YTM at purchase was 5% instead of the above 7%?

Price at sale (at end of year 2, YTM = 5%): 1,060 / 1.05 = 1,009.52 or

N = 1; I/Y = 5; FV = 1,000; PMT = 60; CPT → PV = –1,009.52

Coupon interest and reinvestment income for two years: 60(1.05) + 60 = 123.00 or

N = 2; I/Y = 5; PV = 0; PMT = 60; CPT → FV = –123.00

Intuition?

A bond will have a rate of return =

YTM at maturity; if we sell some of

the remaining value of the bond

discounted at that YTM, we will

have earned that YTM up to the

date of sale.