Page 5 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 5

Session Unit 16:

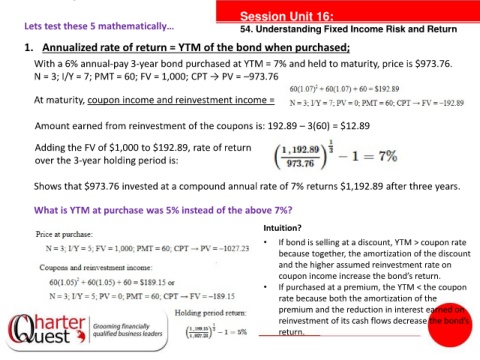

Lets test these 5 mathematically… 54. Understanding Fixed Income Risk and Return

1. Annualized rate of return = YTM of the bond when purchased;

With a 6% annual-pay 3-year bond purchased at YTM = 7% and held to maturity, price is $973.76.

N = 3; I/Y = 7; PMT = 60; FV = 1,000; CPT → PV = –973.76

At maturity, coupon income and reinvestment income =

Amount earned from reinvestment of the coupons is: 192.89 – 3(60) = $12.89

Adding the FV of $1,000 to $192.89, rate of return

over the 3-year holding period is: tanties

Shows that $973.76 invested at a compound annual rate of 7% returns $1,192.89 after three years.

What is YTM at purchase was 5% instead of the above 7%?

Intuition?

• If bond is selling at a discount, YTM > coupon rate

because together, the amortization of the discount

and the higher assumed reinvestment rate on

coupon income increase the bond’s return.

• If purchased at a premium, the YTM < the coupon

rate because both the amortization of the

premium and the reduction in interest earned on

reinvestment of its cash flows decrease the bond’s

return.