Page 9 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 9

LOS 54.b: Define, calculate, and interpret Macaulay,

modified, and effective durations, p.103 Session Unit 16:

54. Understanding Fixed Income Risk and Return

Macaulay Duration (MacDur)

• Duration is used as a measure of a bond’s interest rate risk or sensitivity of a bond’s full price to a

change in its yield.

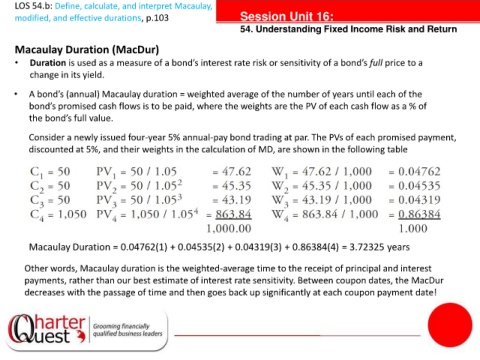

• A bond’s (annual) Macaulay duration = weighted average of the number of years until each of the

bond’s promised cash flows is to be paid, where the weights are the PV of each cash flow as a % of

the bond’s full value.

Consider a newly issued four-year 5% annual-pay bond trading at par. The PVs of each promised payment,

tanties

discounted at 5%, and their weights in the calculation of MD, are shown in the following table

Macaulay Duration = 0.04762(1) + 0.04535(2) + 0.04319(3) + 0.86384(4) = 3.72325 years

Other words, Macaulay duration is the weighted-average time to the receipt of principal and interest

payments, rather than our best estimate of interest rate sensitivity. Between coupon dates, the MacDur

decreases with the passage of time and then goes back up significantly at each coupon payment date!