Page 414 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 414

Chapter 20

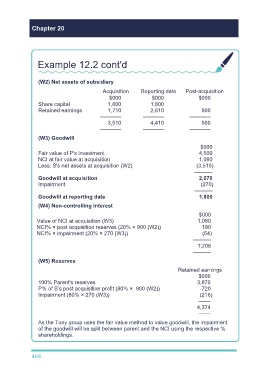

Example 12.2 cont'd

(W2) Net assets of subsidiary

Acquisition Reporting date Post-acquisition

$000 $000 $000

Share capital 1,800 1,800

Retained earnings 1,710 2,610 900

––––––– ––––––– –––––––

3,510 4,410 900

––––––– ––––––– –––––––

(W3) Goodwill

$000

Fair value of P's investment 4,500

NCI at fair value at acquisition 1,080

Less: S's net assets at acquisition (W2) (3,510)

––––––

Goodwill at acquisition 2,070

Impairment (270)

––––––

Goodwill at reporting date 1,800

(W4) Non-controlling interest

$000

Value of NCI at acquisition (W3) 1,080

NCI% × post acquisition reserves (20% × 900 (W2)) 180

NCI% × impairment (20% × 270 (W3)) (54)

––––––

1,206

––––––

(W5) Reserves

Retained earnings

$000

100% Parent's reserves 3,870

P% of S’s post acquisition profit (80% × 900 (W2)) 720

Impairment (80% × 270 (W3)) (216)

––––

4,374

––––

As the Tony group uses the fair value method to value goodwill, the impairment

of the goodwill will be split between parent and the NCI using the respective %

shareholdings.

406