Page 418 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 418

Chapter 20

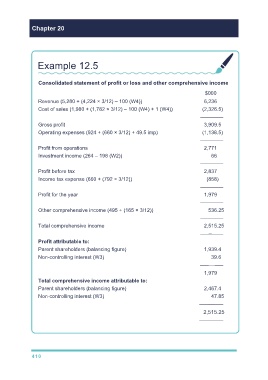

Example 12.5

Consolidated statement of profit or loss and other comprehensive income

$000

Revenue (5,280 + (4,224 × 3/12) – 100 (W4)) 6,236

Cost of sales (1,980 + (1,782 × 3/12) – 100 (W4) + 1 (W4)) (2,326.5)

––––––––

Gross profit 3,909.5

Operating expenses (924 + (660 × 3/12) + 49.5 imp) (1,138.5)

––––––––

Profit from operations 2,771

Investment income (264 – 198 (W2)) 66

––––––––

Profit before tax 2,837

Income tax expense (660 + (792 × 3/12)) (858)

––––––––

Profit for the year 1,979

––––––––

Other comprehensive income (495 + (165 × 3/12)) 536.25

––––––––

Total comprehensive income 2,515.25

––––––––

Profit attributable to:

Parent shareholders (balancing figure) 1,939.4

Non-controlling interest (W3) 39.6

––––––––

1,979

Total comprehensive income attributable to:

Parent shareholders (balancing figure) 2,467.4

Non-controlling interest (W3) 47.85

––––––––

2,515.25

––––––––

410