Page 419 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 419

Answers

Example 12.5 cont'd

Workings

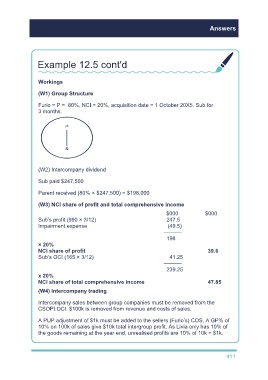

(W1) Group Structure

Furio = P = 80%, NCI = 20%, acquisition date = 1 October 20X5. Sub for

3 months.

(W2) Intercompany dividend

Sub paid $247,500

Parent received (80% × $247,500) = $198,000

(W3) NCI share of profit and total comprehensive income

$000 $000

Sub’s profit (990 × 3/12) 247.5

Impairment expense (49.5)

––––––

198

× 20%

NCI share of profit 39.6

Sub’s OCI (165 × 3/12) 41.25

––––––

239.25

x 20%

NCI share of total comprehensive income 47.85

(W4) Intercompany trading

Intercompany sales between group companies must be removed from the

CSOPLOCI. $100k is removed from revenue and costs of sales.

A PUP adjustment of $1k must be added to the sellers (Furio’s) COS. A GP% of

10% on 100k of sales give $10k total intergroup profit. As Livia only has 10% of

the goods remaining at the year end, unrealised profits are 10% of 10k = $1k.

411