Page 423 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 423

Answers

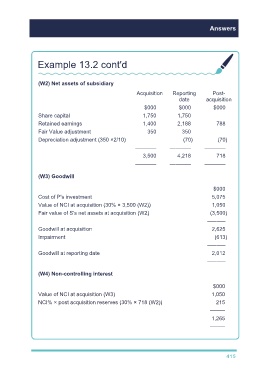

Example 13.2 cont'd

(W2) Net assets of subsidiary

Acquisition Reporting Post-

date acquisition

$000 $000 $000

Share capital 1,750 1,750

Retained earnings 1,400 2,188 788

Fair Value adjustment 350 350

Depreciation adjustment (350 ×2/10) (70) (70)

––––––– ––––––– –––––––

3,500 4,218 718

––––––– ––––––– –––––––

(W3) Goodwill

$000

Cost of P's investment 5,075

Value of NCI at acquisition (30% × 3,500 (W2)) 1,050

Fair value of S's net assets at acquisition (W2) (3,500)

––––––

Goodwill at acquisition 2,625

Impairment (613)

––––––

Goodwill at reporting date 2,012

––––––

(W4) Non-controlling interest

$000

Value of NCI at acquisition (W3) 1,050

NCI% × post acquisition reserves (30% × 718 (W2)) 215

–––––

1,265

–––––

415