Page 416 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 416

Chapter 20

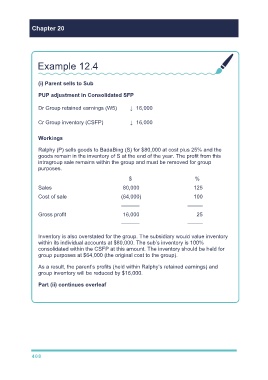

Example 12.4

(i) Parent sells to Sub

PUP adjustment in Consolidated SFP

Dr Group retained earnings (W5) ↓ 16,000

Cr Group inventory (CSFP) ↓ 16,000

Workings

Ralphy (P) sells goods to BadaBing (S) for $80,000 at cost plus 25% and the

goods remain in the inventory of S at the end of the year. The profit from this

intragroup sale remains within the group and must be removed for group

purposes.

$ %

Sales 80,000 125

Cost of sale (64,000) 100

–––––– –––––

Gross profit 16,000 25

–––––– –––––

Inventory is also overstated for the group. The subsidiary would value inventory

within its individual accounts at $80,000. The sub’s inventory is 100%

consolidated within the CSFP at this amount. The inventory should be held for

group purposes at $64,000 (the original cost to the group).

As a result, the parent’s profits (held within Ralphy’s retained earnings) and

group inventory will be reduced by $16,000.

Part (ii) continues overleaf

408