Page 12 - CIMA OCS Workbook February 2019 - Day 1 Suggested Solutions

P. 12

CIMA FEBRUARY 2019 – OPERATIONAL CASE STUDY

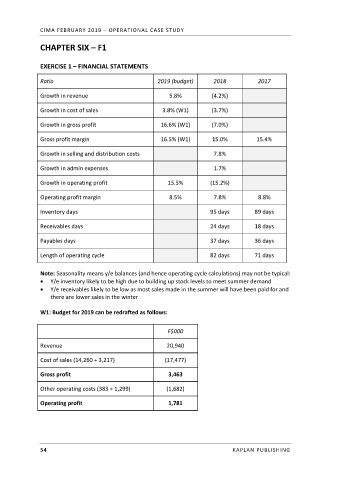

CHAPTER SIX – F1

EXERCISE 1 – FINANCIAL STATEMENTS

Ratio 2019 (budget) 2018 2017

Growth in revenue 5.8% (4.2%)

Growth in cost of sales 3.8% (W1) (3.7%)

Growth in gross profit 16.6% (W1) (7.0%)

Gross profit margin 16.5% (W1) 15.0% 15.4%

Growth in selling and distribution costs 7.8%

Growth in admin expenses 1.7%

Growth in operating profit 15.5% (15.2%)

Operating profit margin 8.5% 7.8% 8.8%

Inventory days 95 days 89 days

Receivables days 24 days 18 days

Payables days 37 days 36 days

Length of operating cycle 82 days 71 days

Note: Seasonality means y/e balances (and hence operating cycle calculations) may not be typical:

• Y/e inventory likely to be high due to building up stock levels to meet summer demand

• Y/e receivables likely to be low as most sales made in the summer will have been paid for and

there are lower sales in the winter

W1: Budget for 2019 can be redrafted as follows:

F$000

Revenue 20,940

Cost of sales (14,260 + 3,217) (17,477)

Gross profit 3,463

Other operating costs (383 + 1,299) (1,682)

Operating profit 1,781

54 KAPLAN PUBLISHING