Page 17 - Companies & Dividend Tax

P. 17

COMPANIES & CLOSE CORPORATIONS

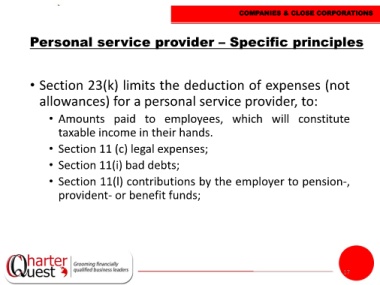

Personal service provider – Specific principles

• Section 23(k) limits the deduction of expenses (not

allowances) for a personal service provider, to:

• Amounts paid to employees, which will constitute

taxable income in their hands.

• Section 11 (c) legal expenses;

• Section 11(i) bad debts;

• Section 11(l) contributions by the employer to pension-,

provident- or benefit funds;

17