Page 21 - Companies & Dividend Tax

P. 21

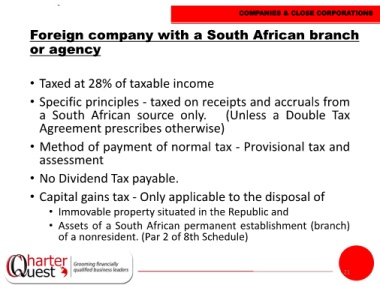

COMPANIES & CLOSE CORPORATIONS

Foreign company with a South African branch

or agency

• Taxed at 28% of taxable income

• Specific principles - taxed on receipts and accruals from

a South African source only. (Unless a Double Tax

Agreement prescribes otherwise)

• Method of payment of normal tax - Provisional tax and

assessment

• No Dividend Tax payable.

• Capital gains tax - Only applicable to the disposal of

• Immovable property situated in the Republic and

• Assets of a South African permanent establishment (branch)

of a nonresident. (Par 2 of 8th Schedule)

21