Page 22 - Companies & Dividend Tax

P. 22

COMPANIES & CLOSE CORPORATIONS

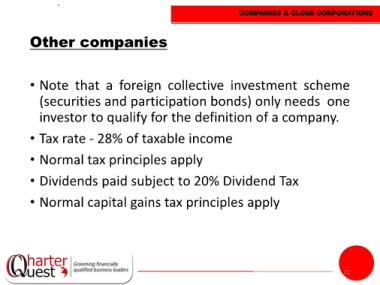

Other companies

• Note that a foreign collective investment scheme

(securities and participation bonds) only needs one

investor to qualify for the definition of a company.

• Tax rate - 28% of taxable income

• Normal tax principles apply

• Dividends paid subject to 20% Dividend Tax

• Normal capital gains tax principles apply

22