Page 18 - Companies & Dividend Tax

P. 18

COMPANIES & CLOSE CORPORATIONS

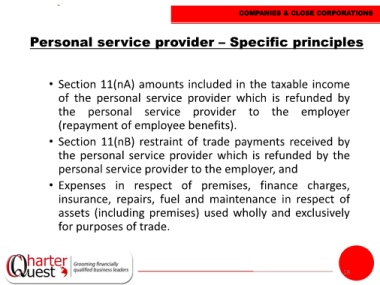

Personal service provider – Specific principles

• Section 11(nA) amounts included in the taxable income

of the personal service provider which is refunded by

the personal service provider to the employer

(repayment of employee benefits).

• Section 11(nB) restraint of trade payments received by

the personal service provider which is refunded by the

personal service provider to the employer, and

• Expenses in respect of premises, finance charges,

insurance, repairs, fuel and maintenance in respect of

assets (including premises) used wholly and exclusively

for purposes of trade.

18