Page 19 - Companies & Dividend Tax

P. 19

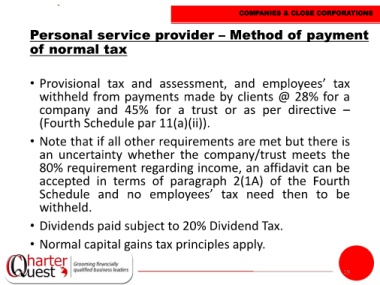

COMPANIES & CLOSE CORPORATIONS

Personal service provider – Method of payment

of normal tax

• Provisional tax and assessment, and employees’ tax

withheld from payments made by clients @ 28% for a

company and 45% for a trust or as per directive –

(Fourth Schedule par 11(a)(ii)).

• Note that if all other requirements are met but there is

an uncertainty whether the company/trust meets the

80% requirement regarding income, an affidavit can be

accepted in terms of paragraph 2(1A) of the Fourth

Schedule and no employees’ tax need then to be

withheld.

• Dividends paid subject to 20% Dividend Tax.

• Normal capital gains tax principles apply.

19