Page 3 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 3

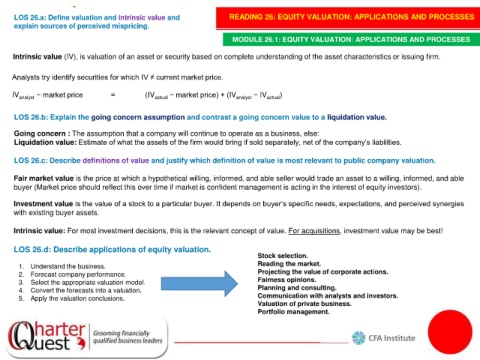

LOS 26.a: Define valuation and intrinsic value and READING 26: EQUITY VALUATION: APPLICATIONS AND PROCESSES

explain sources of perceived mispricing.

MODULE 26.1: EQUITY VALUATION: APPLICATIONS AND PROCESSES

Intrinsic value (IV), is valuation of an asset or security based on complete understanding of the asset characteristics or issuing firm.

Analysts try identify securities for which IV ≠ current market price.

IV analyst − market price = (IV actual − market price) + (IV analyst − IV actual )

LOS 26.b: Explain the going concern assumption and contrast a going concern value to a liquidation value.

Going concern : The assumption that a company will continue to operate as a business, else:

Liquidation value: Estimate of what the assets of the firm would bring if sold separately, net of the company’s liabilities.

LOS 26.c: Describe definitions of value and justify which definition of value is most relevant to public company valuation.

Fair market value is the price at which a hypothetical willing, informed, and able seller would trade an asset to a willing, informed, and able

buyer (Market price should reflect this over time if market is confident management is acting in the interest of equity investors).

Investment value is the value of a stock to a particular buyer. It depends on buyer’s specific needs, expectations, and perceived synergies

with existing buyer assets.

Intrinsic value: For most investment decisions, this is the relevant concept of value. For acquisitions, investment value may be best!

LOS 26.d: Describe applications of equity valuation.

Stock selection.

1. Understand the business. Reading the market.

2. Forecast company performance. Projecting the value of corporate actions.

3. Select the appropriate valuation model. Fairness opinions.

4. Convert the forecasts into a valuation. Planning and consulting.

5. Apply the valuation conclusions. Communication with analysts and investors.

Valuation of private business.

Portfolio management.