Page 7 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 7

LOS 27.b: Calculate and interpret an equity risk READING 27: RETURN CONCEPTS

premium using historical and forward-looking

estimation approaches.

MODULE 27.1: RETURN CONCEPTS

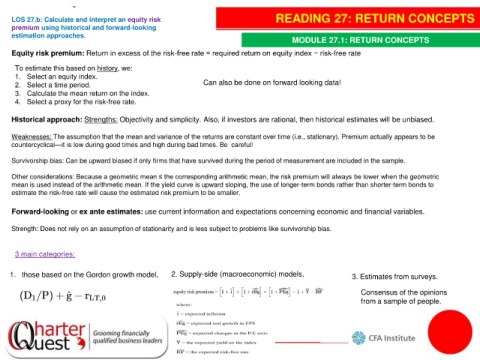

Equity risk premium: Return in excess of the risk-free rate = required return on equity index − risk-free rate

To estimate this based on history, we:

1. Select an equity index.

2. Select a time period. Can also be done on forward looking data!

3. Calculate the mean return on the index.

4. Select a proxy for the risk-free rate.

Historical approach: Strengths: Objectivity and simplicity. Also, if investors are rational, then historical estimates will be unbiased.

Weaknesses: The assumption that the mean and variance of the returns are constant over time (i.e., stationary). Premium actually appears to be

countercyclical—it is low during good times and high during bad times. Be careful!

Survivorship bias: Can be upward biased if only firms that have survived during the period of measurement are included in the sample.

Other considerations: Because a geometric mean ≤ the corresponding arithmetic mean, the risk premium will always be lower when the geometric

mean is used instead of the arithmetic mean. If the yield curve is upward sloping, the use of longer-term bonds rather than shorter-term bonds to

estimate the risk-free rate will cause the estimated risk premium to be smaller.

Forward-looking or ex ante estimates: use current information and expectations concerning economic and financial variables.

Strength: Does not rely on an assumption of stationarity and is less subject to problems like survivorship bias.

3 main categories:

1. those based on the Gordon growth model, 2. Supply-side (macroeconomic) models, 3. Estimates from surveys.

Consensus of the opinions

from a sample of people.