Page 9 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 9

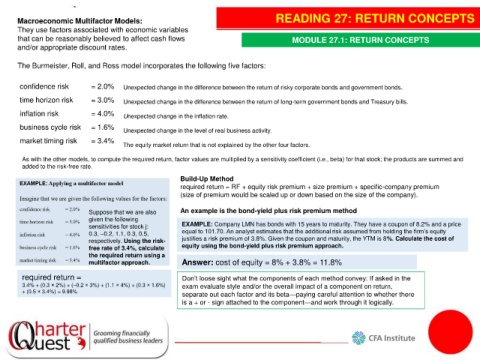

Macroeconomic Multifactor Models: READING 27: RETURN CONCEPTS

They use factors associated with economic variables

that can be reasonably believed to affect cash flows MODULE 27.1: RETURN CONCEPTS

and/or appropriate discount rates.

The Burmeister, Roll, and Ross model incorporates the following five factors:

confidence risk = 2.0% Unexpected change in the difference between the return of risky corporate bonds and government bonds.

time horizon risk = 3.0% Unexpected change in the difference between the return of long-term government bonds and Treasury bills.

inflation risk = 4.0% Unexpected change in the inflation rate.

business cycle risk = 1.6%

Unexpected change in the level of real business activity.

market timing risk = 3.4%

The equity market return that is not explained by the other four factors.

As with the other models, to compute the required return, factor values are multiplied by a sensitivity coefficient (i.e., beta) for that stock; the products are summed and

added to the risk-free rate.

Build-Up Method

required return = RF + equity risk premium + size premium + specific-company premium

(size of premium would be scaled up or down based on the size of the company).

Suppose that we are also An example is the bond-yield plus risk premium method

given the following

sensitivities for stock j: EXAMPLE: Company LMN has bonds with 15 years to maturity. They have a coupon of 8.2% and a price

0.3, –0.2, 1.1, 0.3, 0.5, equal to 101.70. An analyst estimates that the additional risk assumed from holding the firm’s equity

respectively. Using the risk- justifies a risk premium of 3.8%. Given the coupon and maturity, the YTM is 8%. Calculate the cost of

free rate of 3.4%, calculate equity using the bond-yield plus risk premium approach.

the required return using a

multifactor approach. Answer: cost of equity = 8% + 3.8% = 11.8%

required return = Don’t loose sight what the components of each method convey: If asked in the

3.4% + (0.3 × 2%) + (–0.2 × 3%) + (1.1 × 4%) + (0.3 × 1.6%) exam evaluate style and/or the overall impact of a component on return,

+ (0.5 × 3.4%) = 9.98%

separate out each factor and its beta—paying careful attention to whether there

is a + or - sign attached to the component—and work through it logically.