Page 11 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 11

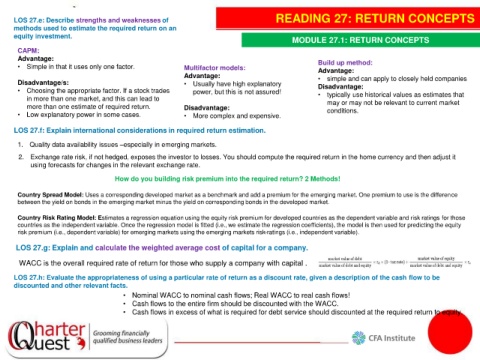

LOS 27.e: Describe strengths and weaknesses of READING 27: RETURN CONCEPTS

methods used to estimate the required return on an

equity investment.

MODULE 27.1: RETURN CONCEPTS

CAPM:

Advantage: Build up method:

• Simple in that it uses only one factor. Multifactor models: Advantage:

Advantage: • simple and can apply to closely held companies

Disadvantage/s: • Usually have high explanatory Disadvantage:

• Choosing the appropriate factor. If a stock trades power, but this is not assured! • typically use historical values as estimates that

in more than one market, and this can lead to may or may not be relevant to current market

more than one estimate of required return. Disadvantage:

• Low explanatory power in some cases. • More complex and expensive. conditions.

LOS 27.f: Explain international considerations in required return estimation.

1. Quality data availability issues –especially in emerging markets.

2. Exchange rate risk, if not hedged, exposes the investor to losses. You should compute the required return in the home currency and then adjust it

using forecasts for changes in the relevant exchange rate.

How do you building risk premium into the required return? 2 Methods!

Country Spread Model: Uses a corresponding developed market as a benchmark and add a premium for the emerging market. One premium to use is the difference

between the yield on bonds in the emerging market minus the yield on corresponding bonds in the developed market.

Country Risk Rating Model: Estimates a regression equation using the equity risk premium for developed countries as the dependent variable and risk ratings for those

countries as the independent variable. Once the regression model is fitted (i.e., we estimate the regression coefficients), the model is then used for predicting the equity

risk premium (i.e., dependent variable) for emerging markets using the emerging markets risk-ratings (i.e., independent variable).

LOS 27.g: Explain and calculate the weighted average cost of capital for a company.

WACC is the overall required rate of return for those who supply a company with capital .

LOS 27.h: Evaluate the appropriateness of using a particular rate of return as a discount rate, given a description of the cash flow to be

discounted and other relevant facts.

• Nominal WACC to nominal cash flows; Real WACC to real cash flows!

• Cash flows to the entire firm should be discounted with the WACC.

• Cash flows in excess of what is required for debt service should discounted at the required return to equity.