Page 14 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 14

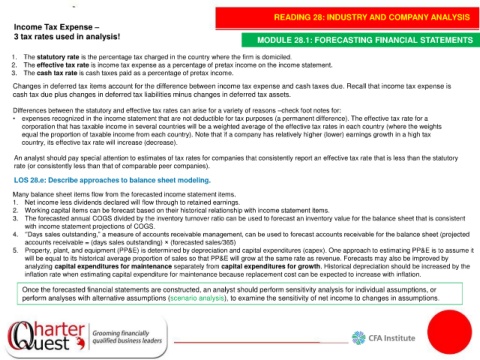

READING 28: INDUSTRY AND COMPANY ANALYSIS

Income Tax Expense –

3 tax rates used in analysis! MODULE 28.1: FORECASTING FINANCIAL STATEMENTS

1. The statutory rate is the percentage tax charged in the country where the firm is domiciled.

2. The effective tax rate is income tax expense as a percentage of pretax income on the income statement.

3. The cash tax rate is cash taxes paid as a percentage of pretax income.

Changes in deferred tax items account for the difference between income tax expense and cash taxes due. Recall that income tax expense is

cash tax due plus changes in deferred tax liabilities minus changes in deferred tax assets.

Differences between the statutory and effective tax rates can arise for a variety of reasons –check foot notes for:

• expenses recognized in the income statement that are not deductible for tax purposes (a permanent difference). The effective tax rate for a

corporation that has taxable income in several countries will be a weighted average of the effective tax rates in each country (where the weights

equal the proportion of taxable income from each country). Note that if a company has relatively higher (lower) earnings growth in a high tax

country, its effective tax rate will increase (decrease).

An analyst should pay special attention to estimates of tax rates for companies that consistently report an effective tax rate that is less than the statutory

rate (or consistently less than that of comparable peer companies).

LOS 28.e: Describe approaches to balance sheet modeling.

Many balance sheet items flow from the forecasted income statement items.

1. Net income less dividends declared will flow through to retained earnings.

2. Working capital items can be forecast based on their historical relationship with income statement items.

3. The forecasted annual COGS divided by the inventory turnover ratio can be used to forecast an inventory value for the balance sheet that is consistent

with income statement projections of COGS.

4. ‘’Days sales outstanding,” a measure of accounts receivable management, can be used to forecast accounts receivable for the balance sheet (projected

accounts receivable = (days sales outstanding) × (forecasted sales/365)

5. Property, plant, and equipment (PP&E) is determined by depreciation and capital expenditures (capex). One approach to estimating PP&E is to assume it

will be equal to its historical average proportion of sales so that PP&E will grow at the same rate as revenue. Forecasts may also be improved by

analyzing capital expenditures for maintenance separately from capital expenditures for growth. Historical depreciation should be increased by the

inflation rate when estimating capital expenditure for maintenance because replacement cost can be expected to increase with inflation.

Once the forecasted financial statements are constructed, an analyst should perform sensitivity analysis for individual assumptions, or

perform analyses with alternative assumptions (scenario analysis), to examine the sensitivity of net income to changes in assumptions.