Page 13 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 13

LOS 28.d: Forecast the following costs: cost of goods READING 28: INDUSTRY AND COMPANY ANALYSIS

sold, selling general and administrative costs, financing

costs, and income taxes.

MODULE 28.1: FORECASTING FINANCIAL STATEMENTS

Cost of Goods Sold (COGS)

forecast COGS = (historical COGS / revenue) × (estimate of future revenue) Estimates of a firm’s COGS may also be improved by

or forecasting COGS for the firm’s various product categories

forecast COGS = (1 − gross margin)(estimate of future revenue) and business segments separately.

Selling General and Administrative Costs (SG&A)

Less sensitive to changes in sales volume (some are fixed, some variable, come have both components):

• More fixed than variable: Corporate headquarters, management salaries, and IT operations.

• More variable than fixed: Selling and distribution costs.

If AFS break out the components of SG&A separately, the different components can be considered separately to improve the overall forecast of SG&A

expenses. If segment information for SG&A is provided and different segments have significant differences in SG&A as a percentage of revenue, SG&A

for each segment can be forecasted to produce better estimates of segment operating margins going forward.

Financing Cost

The primary determinants of gross interest expense are the level of (gross) debt and market interest rates.

Companies may also have interest income from investments. This is especially true for banks and other financial companies, and less so for nonfinancial

companies such as manufacturers. Net debt is gross debt minus cash, cash equivalents, and short-term securities. Net interest expense is gross interest

expense minus interest income on cash and short-term debt securities.

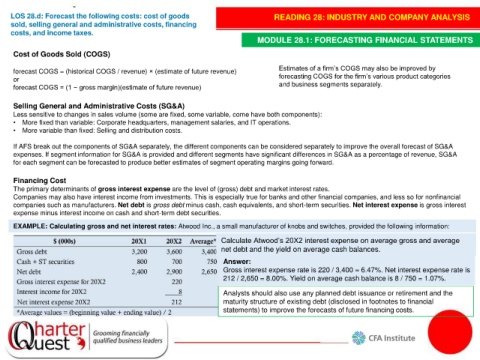

EXAMPLE: Calculating gross and net interest rates: Atwood Inc., a small manufacturer of knobs and switches, provided the following information:

Calculate Atwood’s 20X2 interest expense on average gross and average

net debt and the yield on average cash balances.

Answer:

Gross interest expense rate is 220 / 3,400 = 6.47%. Net interest expense rate is

212 / 2,650 = 8.00%. Yield on average cash balance is 8 / 750 = 1.07%.

Analysts should also use any planned debt issuance or retirement and the

maturity structure of existing debt (disclosed in footnotes to financial

statements) to improve the forecasts of future financing costs.