Page 12 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 12

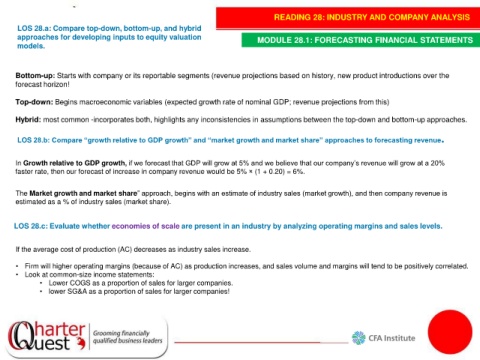

READING 28: INDUSTRY AND COMPANY ANALYSIS

LOS 28.a: Compare top-down, bottom-up, and hybrid

approaches for developing inputs to equity valuation MODULE 28.1: FORECASTING FINANCIAL STATEMENTS

models.

Bottom-up: Starts with company or its reportable segments (revenue projections based on history, new product introductions over the

forecast horizon!

Top-down: Begins macroeconomic variables (expected growth rate of nominal GDP; revenue projections from this)

Hybrid: most common -incorporates both, highlights any inconsistencies in assumptions between the top-down and bottom-up approaches.

LOS 28.b: Compare “growth relative to GDP growth” and “market growth and market share” approaches to forecasting revenue.

In Growth relative to GDP growth, if we forecast that GDP will grow at 5% and we believe that our company’s revenue will grow at a 20%

faster rate, then our forecast of increase in company revenue would be 5% × (1 + 0.20) = 6%.

The Market growth and market share” approach, begins with an estimate of industry sales (market growth), and then company revenue is

estimated as a % of industry sales (market share).

LOS 28.c: Evaluate whether economies of scale are present in an industry by analyzing operating margins and sales levels.

If the average cost of production (AC) decreases as industry sales increase.

• Firm will higher operating margins (because of AC) as production increases, and sales volume and margins will tend to be positively correlated.

• Look at common-size income statements:

• Lower COGS as a proportion of sales for larger companies.

• lower SG&A as a proportion of sales for larger companies!