Page 8 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 8

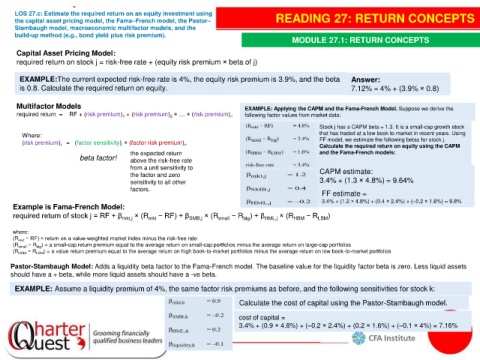

LOS 27.c: Estimate the required return on an equity investment using

the capital asset pricing model, the Fama–French model, the Pastor– READING 27: RETURN CONCEPTS

Stambaugh model, macroeconomic multifactor models, and the

build-up method (e.g., bond yield plus risk premium).

MODULE 27.1: RETURN CONCEPTS

Capital Asset Pricing Model:

required return on stock j = risk-free rate + (equity risk premium × beta of j)

EXAMPLE:The current expected risk-free rate is 4%, the equity risk premium is 3.9%, and the beta Answer:

is 0.8. Calculate the required return on equity. 7.12% = 4% + (3.9% × 0.8)

Multifactor Models EXAMPLE: Applying the CAPM and the Fama-French Model. Suppose we derive the

required return = RF + (risk premium) + (risk premium) + … + (risk premium) n following factor values from market data:

2

1

Stock j has a CAPM beta = 1.3. It is a small-cap growth stock

Where: that has traded at a low book to market in recent years. Using

(risk premium) = (factor sensitivity) × (factor risk premium) . i FF model, we estimate the following betas for stock j.

i

Calculate the required return on equity using the CAPM

i

the expected return and the Fama-French models:

beta factor! above the risk-free rate

from a unit sensitivity to

the factor and zero CAPM estimate:

sensitivity to all other 3.4% + (1.3 × 4.8%) = 9.64%

factors.

FF estimate =

3.4% + (1.2 × 4.8%) + (0.4 × 2.4%) + (–0.2 × 1.6%) = 9.8%

Example is Fama-French Model:

required return of stock j = RF + β mkt,j × (R mkt − RF) + β SMB,j × (R small − R ) + β HML,j × (R HBM − R LBM )

big

where:

(R mkt − RF) = return on a value-weighted market index minus the risk-free rate

(R small − R big ) = a small-cap return premium equal to the average return on small-cap portfolios minus the average return on large-cap portfolios

(R HBM − R LBM ) = a value return premium equal to the average return on high book-to-market portfolios minus the average return on low book-to-market portfolios

Pastor-Stambaugh Model: Adds a liquidity beta factor to the Fama-French model. The baseline value for the liquidity factor beta is zero. Less liquid assets

should have a + beta, while more liquid assets should have a -ve beta.

EXAMPLE: Assume a liquidity premium of 4%, the same factor risk premiums as before, and the following sensitivities for stock k:

Calculate the cost of capital using the Pastor-Stambaugh model.

cost of capital =

3.4% + (0.9 × 4.8%) + (–0.2 × 2.4%) + (0.2 × 1.6%) + (–0.1 × 4%) = 7.16%