Page 6 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 6

READING 27: RETURN CONCEPTS

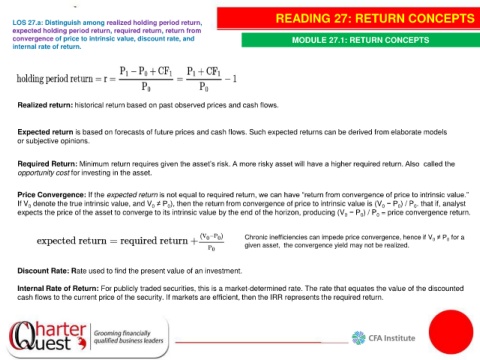

LOS 27.a: Distinguish among realized holding period return,

expected holding period return, required return, return from

convergence of price to intrinsic value, discount rate, and MODULE 27.1: RETURN CONCEPTS

internal rate of return.

Realized return: historical return based on past observed prices and cash flows.

Expected return is based on forecasts of future prices and cash flows. Such expected returns can be derived from elaborate models

or subjective opinions.

Required Return: Minimum return requires given the asset’s risk. A more risky asset will have a higher required return. Also called the

opportunity cost for investing in the asset.

Price Convergence: If the expected return is not equal to required return, we can have “return from convergence of price to intrinsic value.”

If V denote the true intrinsic value, and V ≠ P ), then the return from convergence of price to intrinsic value is (V − P ) / P . that if, analyst

0

0

0

0

0

0

expects the price of the asset to converge to its intrinsic value by the end of the horizon, producing (V − P ) / P = price convergence return.

0

0

0

Chronic inefficiencies can impede price convergence, hence if V ≠ P for a

0

0

given asset, the convergence yield may not be realized.

Discount Rate: Rate used to find the present value of an investment.

Internal Rate of Return: For publicly traded securities, this is a market-determined rate. The rate that equates the value of the discounted

cash flows to the current price of the security. If markets are efficient, then the IRR represents the required return.