Page 15 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 15

LOS 28.f: Describe the relationship between return on READING 28: INDUSTRY AND COMPANY ANALYSIS

invested capital and competitive advantage.

MODULE 28.2: COMPETITIVE ANALYSIS AND GROWTH RATE

Return on invested capital (ROIC) is net operating profit adjusted for taxes

(NOPLAT) divided by invested capital (operating assets minus operating liabilities).

ROIC is a return to both equity and debt and is preferable to return on equity (ROE) in some contexts because it allows comparisons across firms with

different capital structures.

Firms with higher ROIC (relative to their peers) are likely exploiting some competitive advantage in production and/or sale of their products.

A related measure, return on capital employed, is similar to ROIC but uses pretax operating earnings in the numerator to facilitate comparison between

companies that face different tax rates.

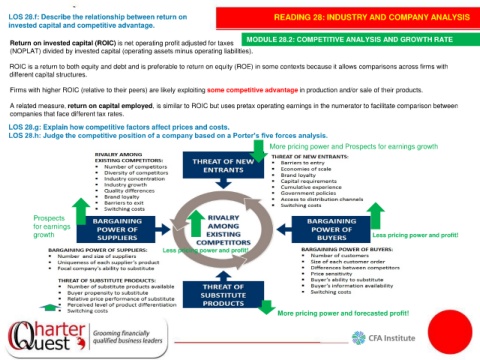

LOS 28.g: Explain how competitive factors affect prices and costs.

LOS 28.h: Judge the competitive position of a company based on a Porter’s five forces analysis.

More pricing power and Prospects for earnings growth

Prospects

for earnings

growth Less pricing power and profit!

Less pricing power and profit!

More pricing power and forecasted profit!