Page 58 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 58

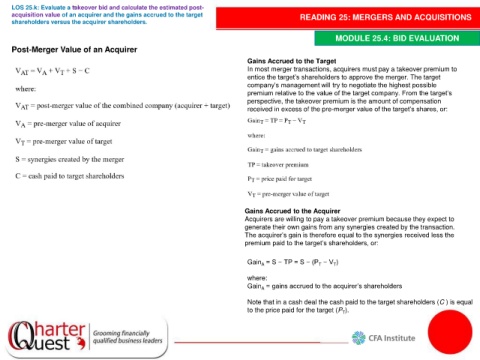

LOS 25.k: Evaluate a takeover bid and calculate the estimated post-

acquisition value of an acquirer and the gains accrued to the target READING 25: MERGERS AND ACQUISITIONS

shareholders versus the acquirer shareholders.

MODULE 25.4: BID EVALUATION

Post-Merger Value of an Acquirer

Gains Accrued to the Target

In most merger transactions, acquirers must pay a takeover premium to

entice the target’s shareholders to approve the merger. The target

company’s management will try to negotiate the highest possible

premium relative to the value of the target company. From the target’s

perspective, the takeover premium is the amount of compensation

received in excess of the pre-merger value of the target’s shares, or:

Gains Accrued to the Acquirer

Acquirers are willing to pay a takeover premium because they expect to

generate their own gains from any synergies created by the transaction.

The acquirer’s gain is therefore equal to the synergies received less the

premium paid to the target’s shareholders, or:

Gain = S − TP = S − (P − V )

T

A

T

where:

Gain = gains accrued to the acquirer’s shareholders

A

Note that in a cash deal the cash paid to the target shareholders (C ) is equal

to the price paid for the target (P ).

T