Page 54 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 54

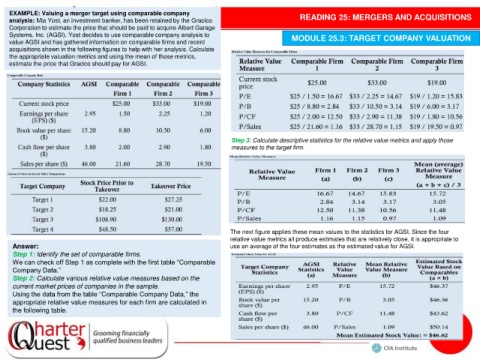

EXAMPLE: Valuing a merger target using comparable company

analysis: Mia Yost, an investment banker, has been retained by the Gracico READING 25: MERGERS AND ACQUISITIONS

Corporation to estimate the price that should be paid to acquire Albert Garage

Systems, Inc. (AGSI). Yost decides to use comparable company analysis to MODULE 25.3: TARGET COMPANY VALUATION

value AGSI and has gathered information on comparable firms and recent

acquisitions shown in the following figures to help with her analysis. Calculate

the appropriate valuation metrics and using the mean of those metrics,

estimate the price that Gracico should pay for AGSI.

Step 3: Calculate descriptive statistics for the relative value metrics and apply those

measures to the target firm.

The next figure applies these mean values to the statistics for AGSI. Since the four

relative value metrics all produce estimates that are relatively close, it is appropriate to

Answer: use an average of the four estimates as the estimated value for AGSI.

Step 1: Identify the set of comparable firms.

We can check off Step 1 as complete with the first table “Comparable

Company Data.”

Step 2: Calculate various relative value measures based on the

current market prices of companies in the sample.

Using the data from the table “Comparable Company Data,” the

appropriate relative value measures for each firm are calculated in

the following table.