Page 55 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 55

READING 25: MERGERS AND ACQUISITIONS

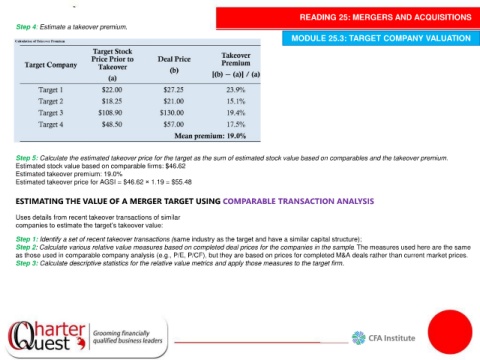

Step 4: Estimate a takeover premium.

MODULE 25.3: TARGET COMPANY VALUATION

Step 5: Calculate the estimated takeover price for the target as the sum of estimated stock value based on comparables and the takeover premium.

Estimated stock value based on comparable firms: $46.62

Estimated takeover premium: 19.0%

Estimated takeover price for AGSI = $46.62 × 1.19 = $55.48

ESTIMATING THE VALUE OF A MERGER TARGET USING COMPARABLE TRANSACTION ANALYSIS

Uses details from recent takeover transactions of similar

companies to estimate the target’s takeover value:

Step 1: Identify a set of recent takeover transactions (same industry as the target and have a similar capital structure);

Step 2: Calculate various relative value measures based on completed deal prices for the companies in the sample. The measures used here are the same

as those used in comparable company analysis (e.g., P/E, P/CF), but they are based on prices for completed M&A deals rather than current market prices.

Step 3: Calculate descriptive statistics for the relative value metrics and apply those measures to the target firm.