Page 57 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 57

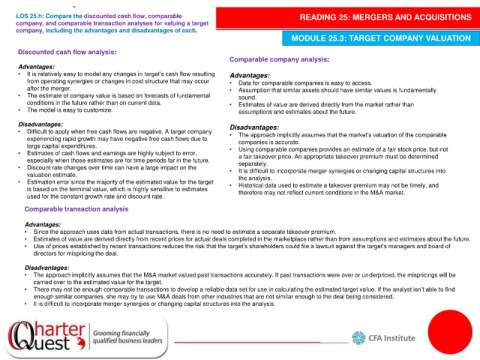

LOS 25.h: Compare the discounted cash flow, comparable READING 25: MERGERS AND ACQUISITIONS

company, and comparable transaction analyses for valuing a target

company, including the advantages and disadvantages of each.

MODULE 25.3: TARGET COMPANY VALUATION

Discounted cash flow analysis:

Comparable company analysis:

Advantages:

• It is relatively easy to model any changes in target’s cash flow resulting Advantages:

from operating synergies or changes in cost structure that may occur • Data for comparable companies is easy to access.

after the merger. • Assumption that similar assets should have similar values is fundamentally

• The estimate of company value is based on forecasts of fundamental sound.

conditions in the future rather than on current data. • Estimates of value are derived directly from the market rather than

• The model is easy to customize. assumptions and estimates about the future.

Disadvantages: Disadvantages:

• Difficult to apply when free cash flows are negative. A target company • The approach implicitly assumes that the market’s valuation of the comparable

experiencing rapid growth may have negative free cash flows due to companies is accurate.

large capital expenditures. • Using comparable companies provides an estimate of a fair stock price, but not

• Estimates of cash flows and earnings are highly subject to error, a fair takeover price. An appropriate takeover premium must be determined

especially when those estimates are for time periods far in the future. separately.

• Discount rate changes over time can have a large impact on the • It is difficult to incorporate merger synergies or changing capital structures into

valuation estimate. the analysis.

• Estimation error since the majority of the estimated value for the target • Historical data used to estimate a takeover premium may not be timely, and

is based on the terminal value, which is highly sensitive to estimates therefore may not reflect current conditions in the M&A market.

used for the constant growth rate and discount rate.

Comparable transaction analysis

Advantages:

• Since the approach uses data from actual transactions, there is no need to estimate a separate takeover premium.

• Estimates of value are derived directly from recent prices for actual deals completed in the marketplace rather than from assumptions and estimates about the future.

• Use of prices established by recent transactions reduces the risk that the target’s shareholders could file a lawsuit against the target’s managers and board of

directors for mispricing the deal.

Disadvantages:

• The approach implicitly assumes that the M&A market valued past transactions accurately. If past transactions were over or underpriced, the mispricings will be

carried over to the estimated value for the target.

• There may not be enough comparable transactions to develop a reliable data set for use in calculating the estimated target value. If the analyst isn’t able to find

enough similar companies, she may try to use M&A deals from other industries that are not similar enough to the deal being considered.

• It is difficult to incorporate merger synergies or changing capital structures into the analysis.