Page 53 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 53

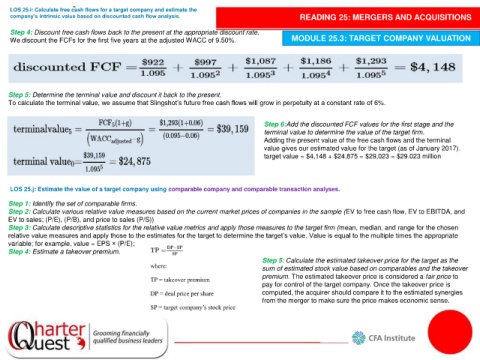

LOS 25.i: Calculate free cash flows for a target company and estimate the

company’s intrinsic value based on discounted cash flow analysis. READING 25: MERGERS AND ACQUISITIONS

Step 4: Discount free cash flows back to the present at the appropriate discount rate.

We discount the FCFs for the first five years at the adjusted WACC of 9.50%. MODULE 25.3: TARGET COMPANY VALUATION

Step 5: Determine the terminal value and discount it back to the present.

To calculate the terminal value, we assume that Slingshot’s future free cash flows will grow in perpetuity at a constant rate of 6%.

Step 6:Add the discounted FCF values for the first stage and the

terminal value to determine the value of the target firm.

Adding the present value of the free cash flows and the terminal

value gives our estimated value for the target (as of January 2017).

target value = $4,148 + $24,875 = $29,023 = $29.023 million

LOS 25.j: Estimate the value of a target company using comparable company and comparable transaction analyses.

Step 1: Identify the set of comparable firms.

Step 2: Calculate various relative value measures based on the current market prices of companies in the sample (EV to free cash flow, EV to EBITDA, and

EV to sales; (P/E), (P/B), and price to sales (P/S))

Step 3: Calculate descriptive statistics for the relative value metrics and apply those measures to the target firm (mean, median, and range for the chosen

relative value measures and apply those to the estimates for the target to determine the target’s value. Value is equal to the multiple times the appropriate

variable; for example, value = EPS × (P/E);

Step 4: Estimate a takeover premium.

Step 5: Calculate the estimated takeover price for the target as the

sum of estimated stock value based on comparables and the takeover

premium. The estimated takeover price is considered a fair price to

pay for control of the target company. Once the takeover price is

computed, the acquirer should compare it to the estimated synergies

from the merger to make sure the price makes economic sense.