Page 52 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 52

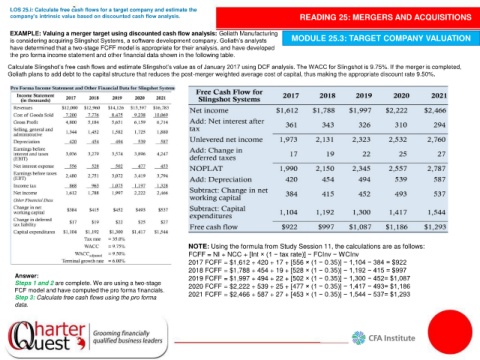

LOS 25.i: Calculate free cash flows for a target company and estimate the

company’s intrinsic value based on discounted cash flow analysis. READING 25: MERGERS AND ACQUISITIONS

EXAMPLE: Valuing a merger target using discounted cash flow analysis: Goliath Manufacturing

is considering acquiring Slingshot Systems, a software development company. Goliath’s analysts MODULE 25.3: TARGET COMPANY VALUATION

have determined that a two-stage FCFF model is appropriate for their analysis, and have developed

the pro forma income statement and other financial data shown in the following table.

Calculate Slingshot’s free cash flows and estimate Slingshot’s value as of January 2017 using DCF analysis. The WACC for Slingshot is 9.75%. If the merger is completed,

Goliath plans to add debt to the capital structure that reduces the post-merger weighted average cost of capital, thus making the appropriate discount rate 9.50%.

NOTE: Using the formula from Study Session 11, the calculations are as follows:

FCFF = NI + NCC + [Int × (1 − tax rate)] − FCInv − WCInv

2017 FCFF = $1,612 + 420 + 17 + [556 × (1 − 0.35)] − 1,104 − 384 = $922

2018 FCFF = $1,788 + 454 + 19 + [528 × (1 − 0.35)] − 1,192 − 415 = $997

Answer: 2019 FCFF = $1,997 + 494 + 22 + [502 × (1 − 0.35)] − 1,300 − 452= $1,087

Steps 1 and 2 are complete. We are using a two-stage 2020 FCFF = $2,222 + 539 + 25 + [477 × (1 − 0.35)] − 1,417 − 493= $1,186

FCF model and have computed the pro forma financials.

Step 3: Calculate free cash flows using the pro forma 2021 FCFF = $2,466 + 587 + 27 + [453 × (1 − 0.35)] − 1,544 − 537= $1,293

data.